2024.9.5 the police have arrested three men, aged between 20 and 29, for their suspected involvement in a case of attempted robbery with hurt.

three men arrested for attempted robbery with hurt

the police have arrested three men, aged between 20 and 29, for their suspected involvement in a case of attempted robbery with hurt.

on 29 august 2024 at about 7.55pm, the police were alerted to a case of robbery with hurt along hougang street 51. a 19-year-old male teenager was allegedly assaulted by an unknown man.

through follow-up investigations, and with the aid of cctvs and police cameras, officers from ang mo kio police division established the identities of the three men involved and arrested them between 30 august and 3 september 2024. preliminary investigations revealed that on 29 august 2024, the teenager had received an offer from a 29-year-old man on telegram to meet up to trade cryptocurrencies for cash, amounting to about $32,000. investigations also revealed that the transaction was purportedly a sham and the 29-year-old man had allegedly arranged for two other men to assault the teenager with intention to take his money when he turned up. while the teenager was waiting, he was confronted by the two men and was assaulted by one of them. the teenager managed to leave the location with his money still in his possession before the man could take the money.

the 29-year-old man will be charged in court on 5 september 2024 with the offence of robbery with hurt under section 394 of the penal code 1871. the offence carries an imprisonment term of not less than five years and not more than 20 years and caning with not less than 12 strokes. the other two men are assisting with investigations.

the police will not tolerate such brazen acts of crime and will spare no effort to apprehend such offenders and deal with them in accordance with the law. members of the public who encounter such cases are advised to remain calm, take note of the physical appearance and distinctive features of the perpetrator, and call for the police as soon as possible.

public affairs department

singapore police force

05 september 2024 @ 8:59 am

—

三名男子因企图抢劫并造成伤害而被捕

警方逮捕了三名年龄在 20 至 29 岁之间的男子,他们涉嫌参与一起企图抢劫致人受伤的案件。

2024年 8 月 29 日晚上 7 点 55 分左右,警方接到报警,称后港街 51 号发生了一起抢劫致人受伤的案件。一名 19 岁的男孩据称遭到一名不知名男子的袭击。

通过后续调查,并在闭路电视和警方摄像机的帮助下,宏茂桥警署的警员确定了涉案三名男子的身份,并在 2024 年 8 月 30 日至 9 月 3 日期间将他们逮捕。初步调查显示,2024 年 8 月 29 日,这名男孩在 telegram 上收到一名 29 岁男子的邀请,邀请他见面用加密货币换取现金,总额约为 32,000 元。调查还发现,这笔交易据称是一场骗局,这名 29 岁男子据称安排另外两名男子袭击这名少年,意图在他出现时抢走他的钱。当这名少年在等待时,他遇到了这两名男子,其中一名男子对他进行了袭击,在这名男子拿走钱之前,这名少年设法带着钱离开了现场。

这名29 岁男子将于 2024 年 9 月 5 日在法庭上被控犯有《1871 刑法》第 394 条规定的抢劫致人受伤罪,该罪行的刑期为不少于 5 年且不超过 20 年,以及不少于 12 下鞭刑。另外两名男子正在协助调查。

2024.9.4 the police are investigating 98 persons, aged between 13 and 76, for their suspected involvement in unlicensed moneylending activities, following an islandwide operation conducted between 19 and 23 august 2024.

98 persons investigated for unlicensed moneylending activities during five-day islandwide police operation

the police are investigating 98 persons, aged between 13 and 76, for their suspected involvement in unlicensed moneylending activities, following an islandwide operation conducted between 19 and 23 august 2024.

during the five-day operation, officers from the criminal investigation department and the seven police land divisions conducted simultaneous raids island-wide. preliminary investigations revealed that nine persons had allegedly harassed debtors at their residence and 43 persons are believed to be runners who had assisted in unlicensed moneylending activities by carrying out automated teller machine (atm) transfers.

the remaining 46 persons are believed to have opened bank accounts and provided their atm cards. personal identification numbers (pins) and/or internet banking tokens to unlicensed moneylenders to facilitate their unlicensed moneylending activities.

investigations against all the persons are ongoing.

under the moneylenders act 2008, when a bank account, atm card or internet banking token of any person is used to facilitate moneylending by an unlicensed moneylender, that person is presumed to have assisted in carrying on the business of unlicensed moneylending. first-time offenders found guilty of the offence of carrying on or assisting in a business of unlicensed moneylending shall be punished with imprisonment term of up to four years, a fine of not less than $30,000 and not more than $300,000 and caning of not more than six strokes. first-time offenders found guilty of the offence of acting on behalf of an unlicensed moneylender to commit or attempt to commit any acts of harassment shall be punished with imprisonment term of up to five years, a fine of not less than $5,000 and not more than $50,000 and caning of not less than three and not more than six strokes.

the police will continue to take tough enforcement action against those involved in the unlicensed moneylending business, regardless of their roles, and ensure that they face the full brunt of the law. this includes taking action against those who open or give away their bank accounts to aid unlicensed moneylenders.

unlicensed moneylenders will not hesitate to carry out persistent and dangerous harassment acts on the borrowers and their families, such as setting fire and splashing paint at their residences, and locking the gates using chains or bicycle locks to confine the occupants. members of the public are advised to stay away from unlicensed moneylenders to avoid the vicious cycle of harassment, and not to work with or assist them in any way as there are serious legal consequences. the public can call the police at ‘999’ if they suspect or know of anyone who could be involved in unlicensed moneylending activities.

public affairs department

singapore police force

04 september 2024 @ 6:35 pm

—

警方在为期五天的全岛行动中调查了 98 名无牌放贷活动人员

2024 年 8 月 19 日至 23 日,警方在全岛范围内开展了一次行动,目前正对 98 名涉嫌参与无牌放贷活动的人员进行调查,这些人员的年龄在 13 岁至 76 岁之间。

在为期五天的行动中,刑事调查部和七个警察部门的警员在全岛范围内同时进行了突袭。初步调查显示,有 9 人涉嫌在其住所骚扰债务人,43 人被认为是跑腿者,他们通过自动柜员机 (atm) 转账协助无牌放贷活动。

其余 46 人据信开设了银行账户,并向无牌放贷人提供了他们的 atm 卡、个人识别码 (pin) 和/或网上银行令牌,以方便他们进行无牌放贷活动。

2024.9.3 the police have arrested three persons, aged between 15 and 25, for their suspected involvement in two separate cases of loanshark harassment.

three persons arrested for loanshark harassment

the police have arrested three persons, aged between 15 and 25, for their suspected involvement in two separate cases of loanshark harassment.

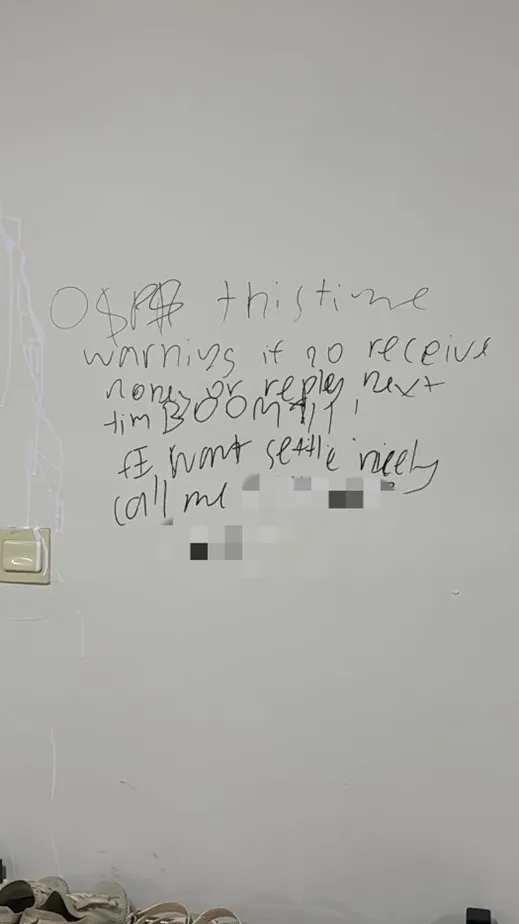

on 31 august 2024, the police were alerted to a case of loanshark harassment at a residential unit along sembawang drive, where the main door and gate of the residential unit were splashed with white paint and graffiti was found scribbled on the wall beside the unit.

through follow-up investigations and with the aid of images from police cameras, officers from woodlands police division established the identity of a 15-year-old teenager and arrested him on 2 september 2024. preliminary investigations revealed that he is allegedly involved in another similar case of loanshark harassment at woodlands street 13.

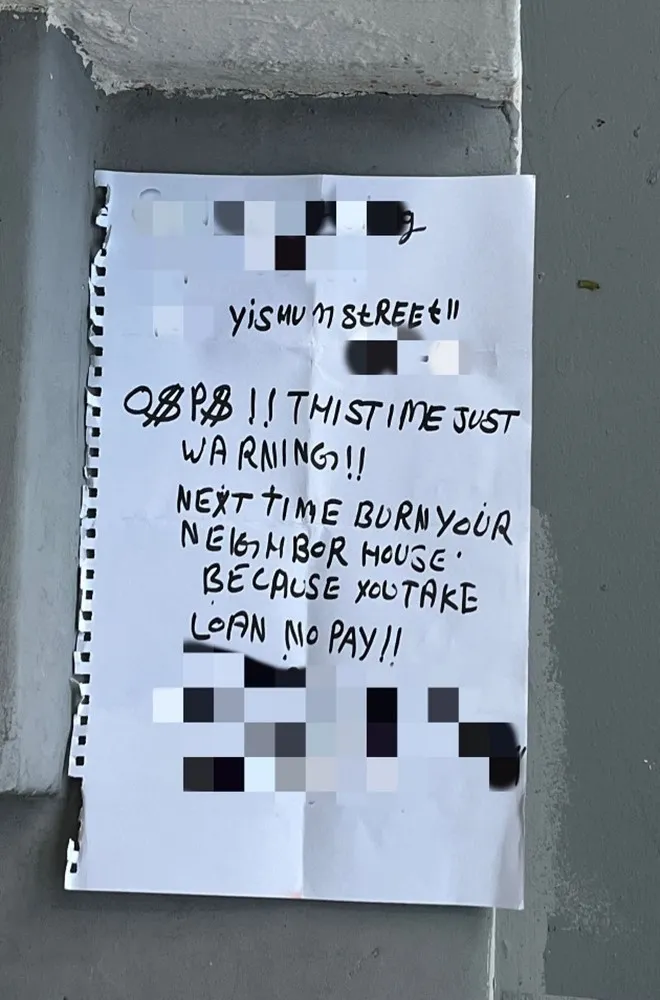

on 2 september 2024, the police were alerted to a case of loanshark harassment at a residential unit along yishun street 11, where the main gate of a residential unit was sprayed with red paint and a debtor’s note was left on the floor in front of the unit.

through follow-up investigations and with the aid of images from police cameras, officers from woodlands, ang mo kio and bedok police divisions established the identities of two men, aged 18 and 25, and arrested them within eight hours of the report. preliminary investigations revealed they are allegedly involved in other similar cases of loanshark harassment islandwide. a can of spray paint and a black marker were seized as case exhibits.

the three persons will be charged in court on 4 september 2024 under the moneylenders act 2008. for first time offenders, the offence of loanshark harassment carries a fine between $5,000 and $50,000, with imprisonment of up to five years and caning of up to six strokes.

the police have zero tolerance for loanshark harassment activities. those who deliberately vandalise properties, cause annoyance or disrupt public safety, peace and security, will be dealt with severely in accordance with the law.

members of the public are advised to stay away from loansharks and not to work with or assist the loansharks in any way. the public can call the police at ‘999’ or the x-ah long hotline at 1800-924-5664 if they suspect or know of anyone who could be involved in loansharking activities.

public affairs department

singapore police force

03 september 2024 @ 12:20 pm

—

三人因高利贷骚扰被捕

警方逮捕了三名年龄在 15 至 25 岁之间的人,他们涉嫌参与两起不同的高利贷骚扰案件。

2024年 8 月 31 日,警方接到报警,称三巴旺道一处住宅单位发生高利贷骚扰事件,该住宅单位的大门和大门被泼上白漆,单位旁边的墙上有涂鸦。

通过后续调查并借助警方摄像机的图像,兀兰警署的警员确定了一名 15 岁青少年的身份,并于 2024 年 9 月 2 日将其逮捕。初步调查显示,他涉嫌参与兀兰街 13 号另一起类似的高利贷骚扰案件。

2024年 9 月 2 日,警方接到报警,义顺街 11 号一处住宅单位发生高利贷骚扰案件,一处住宅单位的大门被喷上红漆,单位门前的地板上留下了一张债务人的纸条。

通过后续调查并借助警方摄像机的图像,兀兰、宏茂桥和勿洛警署的警员确定了两名分别为 18 岁和 25 岁的男子的身份,并在接到报告后的八小时内将他们逮捕。初步调查显示,他们涉嫌参与全国其他类似的高利贷骚扰案件。一罐喷漆和一支黑色记号笔被查获作为案件证物。

这三人将于 2024 年 9 月 4 日根据《2008 放债人法》在法庭上被起诉。对于初犯,高利贷骚扰罪可处以 5,000 至 50,000 元罚款,最高可判处五年监禁和最高六下鞭刑。

2024.8.30 officers from the commercial affairs department and the seven police land divisions conducted a two-week operation between 16 and 29 august 2024. a total of 231 men and 115 women, aged between 16 and 76, are assisting in investigations for their suspected involvement in scams as scammers or money mules. the persons are believed to be involved in more than 1,300 cases of scams, comprising mainly job scams, friend impersonation scams, fake buyer scam, e-commerce scams, investment scams and internet love scams, where victims reportedly lost over $13.8 million.

police investigate 346 scammers and money mules in island-wide enforcement operation

officers from the commercial affairs department and the seven police land divisions conducted a two-week operation between 16 and 29 august 2024. a total of 231 men and 115 women, aged between 16 and 76, are assisting in investigations for their suspected involvement in scams as scammers or money mules. the persons are believed to be involved in more than 1,300 cases of scams, comprising mainly job scams, friend impersonation scams, fake buyer scam, e-commerce scams, investment scams and internet love scams, where victims reportedly lost over $13.8 million.

the persons are being investigated for the alleged offences of cheating, money laundering or providing payment services without a licence. the offence of cheating under section 420 of the penal code 1871 carries an imprisonment term of up to 10 years and a fine. the offence of money laundering under the corruption, drug trafficking and other serious crimes (confiscation of benefits) act 1992 carries an imprisonment term of up to 10 years, a fine of up to $500,000, or both. the offence of carrying on a business to provide any type of payment service in singapore without a licence under section 5 of the payment services act 2019 carries a fine of up to $125,000, an imprisonment term of up to three years, or both.

the police take a serious stance against any person who may be involved in scams, and perpetrators will be dealt with in accordance with the law. to avoid being an accomplice to crimes, members of the public should always reject requests by others to use your bank account or mobile lines as you will be held accountable if these are linked to crimes.

public affairs department

singapore police force

30 august 2024 @ 10:45 am

—

警方在全岛执法行动中调查了 346 名诈骗犯和钱骡

商业事务部和七个分区警署的警员于 2024 年 8 月 16 日至 29 日进行了为期两周的行动。共有 231 名男性和 115 名女性,年龄在 16 至 76 岁之间,因涉嫌以骗子或钱骡的身份参与诈骗而协助调查。这些人被认为涉及 1,300 多起诈骗案件,主要包括求职诈骗、冒充朋友诈骗、假买家诈骗、电子商务诈骗、投资诈骗和网络爱情诈骗,据报道受害者损失了超过 1,380 万元。

警方对任何可能参与诈骗的人采取严肃立场,并将依法处理肇事者。为避免成为犯罪帮凶,公众应始终拒绝他人使用你的银行账户或手机号码的请求,因为如果这些请求与犯罪有关,你将被追究责任。

2024.8.27 the police would like to alert members of the public on the re-emergence of a fake bulk order scam variant. recent cases saw the f&b and service industries being targeted. since april 2024, at least 427 cases were reported, with total losses amounting to at least $6.8 million.

police advisory on fake bulk order scams targeting the renovation, f&b, retail and service industries

the police would like to alert members of the public on the re-emergence of a fake bulk order scam variant. recent cases saw the f&b and service industries being targeted. since april 2024, at least 427 cases were reported, with total losses amounting to at least $6.8 million.

in this scam variant, scammers would typically pose as teachers from academic institutions in singapore and contact restaurants, retailers, or service-related businesses via call or whatsapp message, under the pretext of making bulk orders or to make reservations. scammers would typically request for additional items; or specific brand of items that the businesses typically do not stock, or in quantities that the retailers are unable to fulfil on short notice. the purported customer would then recommend a “supplier” for the victims to purchase from.

scammers may provide screenshots of fake payment documentation to assure the victims that they had made part-payment of the bulk order in advance, which convinced the victims to make upfront payment for the orders placed with the “supplier”. victims would only realise that they had been scammed when they did not receive any payment from the “customer”, or when the “supplier” did not deliver the goods, or when both “customer” and “supplier” become uncontactable.

public affairs department

singapore police force

27 august 2024 @ 2:15 pm

—

警方就针对装修、餐饮、零售和服务行业的虚假批量订单诈骗发出警告

警方希望提醒公众注意一种虚假批量订单诈骗的再次出现。最近的案件以餐饮和服务业为目标。自 2024 年 4 月以来,至少有 427 起案件被报告,总损失至少达 680 万元。

在这种骗局中,骗子通常会冒充新加坡学术机构的教师,并通过电话或 whatsapp 消息联系餐馆、零售商或服务相关企业,借口是批量订购或预订。骗子通常会要求额外的物品;或企业通常没有库存的特定品牌的物品,或零售商无法在短时间内完成的数量。然后,所谓的客户会推荐一个“供应商”供受害者购买。

骗子可能会提供虚假付款文件的截图,以向受害者保证他们已经提前支付了批量订单的部分费用,从而说服受害者为向“供应商”下达的订单预付款。受害者只有在没有收到“客户”的任何付款、“供应商”没有交付货物或“客户”和“供应商”都无法联系时,才会意识到自己被骗了。

2024.8.25 the police have arrested a 29-year-old man for his suspected involvement in a case of attempted housebreaking.

one man arrested for attempted housebreaking

the police have arrested a 29-year-old man for his suspected involvement in a case of attempted housebreaking.

on 24 august 2024 at about 12.10pm, the police were alerted to a case of attempted housebreaking at an office building along 36 robinson road. the security alarm of an office was triggered and tampering marks were found on the entrance and roller shutter of the unit. preliminary investigations revealed that an unknown man had allegedly used a metal rod to tamper with the unit entrance and roller shutter. the man purportedly fled and hid inside one vacant unit at another floor when the security alarm was triggered. through the aid of images from cctvs, the man’s hiding location was eventually found by the security officers. the man opened the door upon the arrival of police officers and was arrested at scene. the metal rod was recovered and seized as case exhibit.

the man will be charged in court on 26 august 2024 with the offence of attempted housebreaking under section 451 read with section 511 of the penal code 1871. the offence carries an imprisonment term of up to 10 years and a fine.

—

警方逮捕一名 29 岁男子,他涉嫌参与一宗企图入室盗窃案。

2024年 8 月 24 日,大约中午 12 点 10 分,警方接到报警,称罗便臣路 36 号一栋办公楼发生一起企图入室盗窃案。办公室的防盗警报被触发,单位入口和卷帘门上发现篡改痕迹。初步调查显示,一名身份不明男子涉嫌使用一根金属棒破坏单位入口和卷帘门。当防盗警报被触发时,该男子据称逃走并藏匿在另一层楼的一个空置单位内。保安人员最终通过闭路电视图像找到了该男子的藏身之处。警察到达后,该男子打开了门,并在现场被捕。金属棒被追回并作为案件证物扣押。

该男子将于 2024 年 8 月 26 日在法庭上被控企图入室盗窃罪,罪名是《1871刑法》第 451 条和第 511 条,该罪行最高可判处 10 年监禁和罚款。

2024.8.23 on 23 august 2024, 63-year-old south korean national kim taek hoon (“kim”) was charged in court for cheating offences under the penal code (cap 224, 2008 rev ed) (“penal code”), money laundering offences as well as offences in relation to a failure to make requisite declarations for cash received from outside singapore under the corruption, drug trafficking and other serious crimes (confiscation of benefits) act (cap 65a, 2000 rev ed) (“cdsa”).

south korean national who exported gold bars concealed in shipments of other goods charged for cheating, money laundering and other offences

on 23 august 2024, 63-year-old south korean national kim taek hoon (“kim”) was charged in court for cheating offences under the penal code (cap 224, 2008 rev ed) (“penal code”), money laundering offences as well as offences in relation to a failure to make requisite declarations for cash received from outside singapore under the corruption, drug trafficking and other serious crimes (confiscation of benefits) act (cap 65a, 2000 rev ed) (“cdsa”).

kim was charged with the following offences:

nine counts of an offence under section 417 of the penal code for cheating the logistics providers;

four counts of an offence under section 417 of the penal code for cheating singapore customs (“customs”);

four counts of an offence under section 48e of the cdsa for failing to make a report in relation to cash exceeding the prescribed amount of s$20,000 which he received from overseas; and

four counts of an offence under section 47(2)(b) of the cdsa for converting cash, which he had reasonable grounds to believe represented another person’s benefits from criminal conduct, into gold bars

background

the suspicious transaction reporting office (“stro”)’s detected possible smuggling activities through analysis of financial intelligence from suspicious transaction reports (“strs”), cash movement reports (“cmrs”), precious stones and precious metals dealers (“psmds”) cash transaction reports (“ctrs”) and international cooperation with foreign counterparts.

this investigation arose from an intelligence probe conducted by the commercial affairs department (“cad”) and cooperation with various agencies including customs and the anti-money laundering / countering the financing of terrorism division (“acd”) of the ministry of law.

kim was arrested in december 2023 after the cad received information suggesting his potential involvement in a scheme to purchase gold bars in singapore and export them in concealed shipments (where declarations were made that they contained other items such as mechanical tools) to south korea and japan.

investigations by the cad revealed that between 2014 and 2017, kim allegedly received smuggled cash from south korea and japan which were concealed in shipments of tools. kim had further allegedly failed to make the requisite declarations of the receipt of cash from overseas, despite each receipt of cash exceeding the prescribed value of s$20,000.

kim allegedly used the cash to purchase gold bars in singapore, before concealing the gold bars in shipments of air impact wrenches for export to south korea and japan through three logistics providers in singapore, while declaring that the shipments only contained air impact wrenches. kim faces charges of cheating for allegedly deceiving the logistics providers into processing the shipments, as well as deceiving customs into issuing cargo clearance permits for these shipments.

director cad, mr david chew said, “singapore is a major transhipment centre and trade hub for the region with tonnes of cargo flowing through our air and sea ports. this flow of trade is vital to our economy but transnational criminal syndicates will seek to abuse these large legitimate flows to conceal their laundering of illicit proceeds. this case illustrates singapore’s ability (through the analysis of strs, cmr and ctrs) to detect these anomalous trade flows and arrest the perpetrators. cad would like to thank interpol and our foreign counterparts for their assistance in exchanging critical information and rendering assistance in this case. this case successfully demonstrates the importance of international cooperation in taking to task individuals who may be part of a bigger transnational criminal syndicate. the cad also appreciates str filers and psmd ctr filers who file reports in a timely manner, contributing to the detection of this complex case of trade-based money laundering”.

if convicted, the offence of money laundering for individuals under section 47(2)(b) of the cdsa carries an imprisonment term of up to 10 years, a fine of up to s$500,000, or both.

the offence of cheating under section 417 of the penal code carries an imprisonment term of up to 3 years, a fine, or with both.

the offence of failing to make a report in respect of cash, the total value of which exceeds s$20,000, which is moved to the person from outside singapore, carries a fine not exceeding s$50,000 or to imprisonment for a term not exceeding 3 years or to both.

public affairs department

singapore police force

23 august 2024 @ 12:20 pm

—

63岁的韩国公民kim taek hoon将金条藏匿于其他货物中出口,被指控欺诈、洗钱和其他罪行

2024.8.20 five men, sufandi bin ahmad (“sufandi”), bijabahadur rai s/o shree kantrai (“bijabahadur”), kok chiew leong (“nicholas”), juma’at bin johari (“juma’at”), and mohamed haron bin hassan (“haron”) were sentenced to imprisonment terms ranging from 10 weeks to 7.5 years for their involvement in mortgage loan frauds.

five men sentenced for involvement in mortgage loan frauds

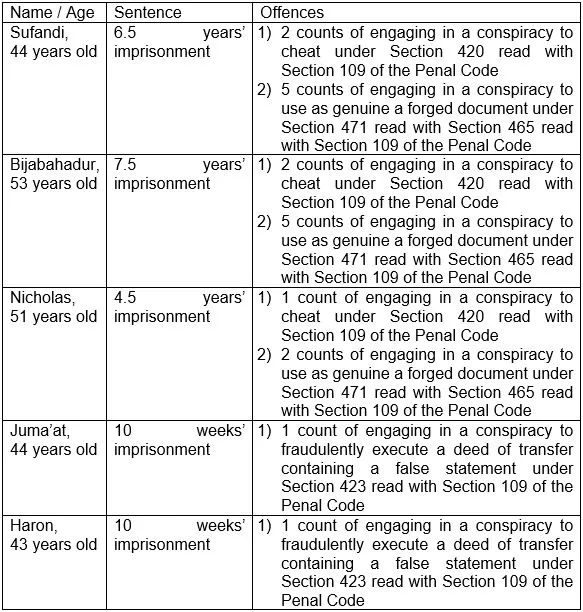

five men, sufandi bin ahmad (“sufandi”), bijabahadur rai s/o shree kantrai (“bijabahadur”), kok chiew leong (“nicholas”), juma’at bin johari (“juma’at”), and mohamed haron bin hassan (“haron”) were sentenced to imprisonment terms ranging from 10 weeks to 7.5 years for their involvement in mortgage loan frauds.

background

between 2014 and 2015, bijabahadur devised a scheme to perpetrate mortgage loan frauds involving two properties. bijabahadur and sufandi were involved in a conspiracy to cheat a bank concerning the two properties, while nicholas was part of their conspiracy for one of the properties. their mortgage loan frauds involved them first arranging with the sellers and the sellers’ property agents to sell the property at a price lower than what was stated on the conveyancing documents, i.e., the price on the conveyancing documents were inflated.

juma’at and haron, the agents for one of the sellers of the properties,[1] reached an agreement with the sellers to hand over monies, equivalent to the difference between the agreed price and the actual stated price, received upon completion of the sale of the property, to the accused persons. the same agreement was reached with the seller of the other property by nicholas. the accused persons then split the monies received from the properties amongst themselves.

as part of their conspiracy, sufandi also recruited individuals who were the purported buyers of these properties. forged income documents in the names of these buyers were submitted to the bank in support of these mortgage loan applications. the bank was deceived, on account of the forged income documents, into disbursing loans amounting to $5,160,000 for two mortgage applications for the two properties. the bank incurred a loss of over $1,790,000 on the two properties. the frauds were eventually uncovered when the nominee buyers defaulted on the loans.[2]

the five men were sentenced as follows:

under section 420 of the penal code, whoever cheats and thereby dishonestly induces the person deceived to deliver any property to any person, shall be punished with imprisonment for a term which may extend to 10 years, and shall also be liable to fine.

under section 471 of the penal code, whoever dishonestly uses as genuine any document which he knows to be a forged document, shall be punished in the same manner as if he had forged such document, which is punishable with imprisonment for a term which may extend to 4 years, or with fine, or with both.

under section 423 of the penal code, whoever fraudulently executes any deed which purports to transfer, and which contains any false statement relating to the consideration for such transfer, shall be punished with imprisonment for a term which may extend to 3 years, or with fine, or with both.

the cheating of a financial institution, including through the submission of forged documents or by the provision of false information, in order to obtain a mortgage loan is a serious offence. the police take a serious view of such offences and perpetrators will be dealt with in accordance with the law.

[1] the seller, mohamad hamzi bin rabu, of the property whom they represented was sentenced to 12 months’ imprisonment for his involvement after he pleaded guilty to a charge under s 423 of the penal code.

[2] one of the nominee buyers, iswandi bin yahya, was sentenced to 24 months’ imprisonment for his involvement after he pleaded guilty to a charge under s 420 of the penal code. the other nominee buyer has been dealt with.

public affairs department

singapore police force

20 august 2024 @ 4:30 pm

—

五名男子 sufandi bin ahmad(“ sufandi ”)、bijabahadur rai s/o shree kantrai(“ bijabahadur ”)、kok chiew leong(“ nicholas ”)、juma’at bin johari(“ juma’at ”)和 mohamed haron bin hassan(“ haron ”)因参与抵押贷款诈骗被判处 10 周至 7.5 年不等的监禁。

2014 年至 2015 年期间,bijabahadur 策划了一项涉及两处房产的抵押贷款诈骗计划。bijabahadur 和 sufandi 参与了一项欺骗银行的阴谋,诈骗涉及两处房产,而 nicholas 则参与了其中一处房产的诈骗。他们的抵押贷款诈骗行为首先涉及与卖方及其房地产经纪人商定以低于产权转让文件上所述的价格出售房产,即产权转让文件上的价格被抬高。

2024.8.15 a singapore court on thursday charged two former bankers for helping a group of foreigners who were convicted of laundering $2.2 billion last year in the biggest such financial crime in the asian financial hub. both wang qiming and liu kai were relationship managers and chinese nationals employed by citibank and swiss private bank julius baer, according to a singapore police force statement and the court documents. wang, 26, faces 10 charges, including laundering almost $380,000 and forging loan documents. liu, 35, was charged with using a forged chinese tax document to help one of the convicted money launderers open a julius baer bank account in switzerland, the court documents showed.

singapore charges 2 former chinese bankers in us$2.3 billion money-laundering scandal

wang qiming and liu kai served some of the criminals involved in the city state’s biggest money-laundering case

singapore charged two former bank relationship managers who it accused of being involved in the country’s biggest money-laundering case, marking its first criminal actions against finance professionals in the s$3 billion (us$2.3 billion) scandal.

wang qiming, a 26-year-old chinese national, was charged with 10 counts including forging documents for the purpose of cheating the bank, according to charge sheets read out in a local state court on thursday. he used to work at citibank singapore ltd., according to records with the monetary authority of singapore.

liu kai, a 35-year-old who was formerly with bank julius baer & co., was accused of aiding one of the now-convicted money launderers in submitting a forged chinese tax document to open a bank account in switzerland.

the charges were read out to both men in mandarin. liu, who is also a chinese citizen, holds singapore permanent residency, according to his charge sheet. they declined to comment after the hearing.

the latest charges come a year after the money laundering scandal first unfolded with a series of arrests of wealthy foreigners who were living in the city state. singapore authorities have seized cash, real estate, cryptocurrencies and other assets totalling about s$3 billion, and sent 10 people of chinese origin to jail this year for laundering illicit funds from overseas gambling operations and other offences. more individuals involved in the scheme remain at large.

the case has also rocked singapore’s banking sector. the convicted china-born individuals and their close associates, together with companies they controlled, held more than s$370 million in total at over a dozen financial institutions, court records compiled by bloomberg show. units of citigroup inc. and ubs group ag-owned credit suisse were among the top banks holding the most in deposits.

the mas has been inspecting multiple banks. the lenders with the most dealing with the criminals – through deposit accounts, loans and other financial services – could face fines and other punitive measures, people familiar with the matter said previously.

wang appeared in court on thursday in a white hooded sweatshirt, black pants and white sneakers. liu was dressed in a dark blue polo shirt. neither entered a plea, and they are currently out on bail. both men are expected to be back in court in september.

wang’s clients included su baolin and vang shuiming, who were among the 10 convicted money launderers. singapore police said that in late 2020, wang helped su make a false loan agreement to mask the source of a deposit made into the latter’s bank account. wang also helped hold s$481,678 in cash he collected from su, and the ex-relationship manager has also been charged with laundering that sum of money.

in addition, wang in 2021 forged remittance receipts from an indonesian company that were used to substantiate two separate s$999,980 deposits into a citibank account, according to the charges. he also forged a loan document to fool citibank about the source of vang’s funds, the police said.

the maximum penalties for these and other offences include jail terms of up to 10 years and fines.

a citi spokesperson said wang has not been employed at the bank since april 2022, adding it does not comment on matters that are before the courts.

liu was a relationship manager for lin baoying, and submitted a forged tax document from the now-convicted money launderer around november 2020 to help her open a bank account in switzerland, where julius baer is based. mas records show that liu worked at the bank from 2019 to 2022.

julius baer did not immediately respond to an emailed request for comment.

a third individual, a 41-year-old singapore citizen who was a driver to one of the suspects in the money laundering case – su binghai, who remains at large – was also criminally charged on thursday.

liew yik kit was charged for helping su to dispose of four luxury cars – two rolls-royces and two ferraris – at a multi-storey car park in a public housing estate last year, and then lying about it to the police.

—

$3b money laundering case: first s’porean charged; he allegedly disposed of rolls-royce, ferrari

singapore – on the first anniversary of the arrests of 10 foreigners in singapore’s largest money laundering case, the first singaporean linked to the crimes was hauled to court.

liew yik kit, 41, was the personal driver to cambodian national su binghai, who fled during the probe and is wanted for his involvement in alleged money laundering offences.

liew was handed two charges on aug 15 – one for lying to the police, and another one for obstructing the course of justice.

he had allegedly lied to police that su did not leave any valuables in his possession, when he actually had the businessman’s four luxury cars – a rolls-royce phantom, a rolls-royce cullinan, a ferrari f8 spider and a ferrari stradale.

the former driver then purportedly disposed of the four cars at the multi-storey carpark at block 20 upper boon keng road between sept 11, 2023, and oct 5, 2023.

this alleged act caused the police to miss out on seizing the four vehicles and obstructed the course of justice.

company records show liew was the authorised representative of a car rental company, quality limo services. the firm is no longer in operation.

liew, who has yet to engage a lawyer, asked the court for time to consider his plea and seek legal advice. he was granted bail of $15,000.

two chinese nationals who were former relationship managers at banks were also charged on aug 15.

liu kai, 35, who was a relationship manager at swiss private bank julius baer, was charged with abetting one of the convicts in the money laundering case to use a forged document.

liu faces one charge of abetting lin baoying, the only woman convicted in the case, to submit a forged tax document in november 2020.

police said liu allegedly received various alterations of a forged tax document from lin before submitting the final version to the bank as a supporting document to facilitate the opening of a bank account in switzerland.

wang qiming, 26, a former relationship manager at citibank, whose clients included two of the 10 convicted money launderers, su baolin and vang shuiming, was handed 10 charges.

according to charge sheets, around december 2020, wang allegedly abetted su baolin in making a false loan agreement to deceive standard chartered bank about the source of the deposit made into su baolin’s bank account.

wang had allegedly possessed $481,678 in cash collected on behalf of su baolin on dec 15, 2020, and could not satisfactorily explain where it came from. he was charged with laundering this sum.

between april 19 and april 25, 2021, he also allegedly forged a loan document to deceive citibank about the source of vang’s funds, thus allowing the deposit of $999,980 into vang’s bank account.

wang faces one count of obstructing the course of justice by deleting the whatsapp application on his mobile phone on oct 12, 2021, which could have contained his communication records with the bank’s clients.

the former citibank employee was also charged with providing false information to an immigration and checkpoints authority officer on nov 15, 2021, claiming he had lost his passport, when it had been surrendered to the singapore police force.

in court affidavits produced during the hearings of the 10 foreigners, commercial affairs department (cad) investigators said they first probed wang over alleged forgery claims before arresting him in 2021.

his employment was terminated in april 2022, according to an earlier statement by the wall street bank.

liu is represented by a legal team from lee & lee, while wang is represented by lawyers from anthony law corp. their lawyers said the men have not indicated any plea.

liu was granted bail of $15,000, while wang was granted bail of $25,000. liew’s and liu’s cases will be heard again on sept 12, and wang’s case is scheduled for sept 19.

on aug 14, cad director david chew said in the police statement: “banks as important gatekeepers of our financial system have compliance systems in place to detect and turn away criminal funds.

“we rely on the integrity of bankers in general and relationship managers, in particular, as the interface between clients and the banks, to ensure this.”

he added that those who help clients circumvent their financial institutions’ due diligence processes or help clients forge documents to conceal the true nature of their assets must be dealt with robustly under singapore’s laws.

on aug 15, 2023, more than 400 police officers raided luxury housing estates in singapore simultaneously and nabbed 10 foreigners.

about $3 billion in cash and assets, including jewellery, watches, cars and bottles of alcohol, were seized or issued with prohibition of disposal orders.

the nine men and one woman were convicted and agreed to surrender more than $900 million in cash and assets as part of their plea deals.

the remaining sum was traced to 17 other suspects who had fled singapore during the probe.

in january 2024, warrants of arrest and interpol red notices were issued against two suspects – cambodian nationals su yongcan, 33, and wang huoqiang, 29.

the 10 convicted were sentenced to jail terms of between 13 and 17 months. all have been deported and barred from re-entering singapore.

su wenqiang, wang baosen, su baolin, su haijin, chen qingyuan, zhang ruijin, lin and su jianfeng were deported to cambodia.

vang was deported to japan, while wang dehai was deported to britain.

—

涉30亿洗钱案 两银行前客户经理与一前司机被控上庭

被告刘义杰是苏炳海的前私人司机,他被控把四辆豪车丢弃在多层停车场,还向警方撒谎。被告王启明被控10项控状,其中包括协助洗钱案被告苏宝林和王水明伪造文件意图欺骗银行。

涉及30亿元洗钱案在逃人员的前私人司机,涉嫌把两辆劳斯莱斯和两辆法拉利弃置多层停车场,还向警方隐瞒此事;他与另外两名涉嫌协助洗钱案被告伪造文件的银行前客户经理,一同被控上庭。

三名被告分别是王启明(26岁,中国籍)、刘凯(35岁,中国籍)和苏炳海的前私人司机刘义杰(41岁,新加坡籍)。他们于星期四(8月15日)在国家法院面控。

这是继10名被告服刑完毕被遣送后,再次有人因涉及同一起洗钱案被控。刘义杰也是第一名因涉案被控的新加坡人。

王启明案发时是花旗银行的客户经理,当时的客户包括洗钱案的两名罪犯苏宝林和王水明。他面对五项伪造文件意图欺骗、两项伪造文件、一项妨碍司法公正、一项提供假口供,以及一项抵触贪污、贩毒和严重罪案(没收利益)法令的控状。

根据控状,王启明涉嫌在2020年12月与苏宝林串谋伪造一份借贷协议,意图欺骗渣打银行;同年12月15日,他涉嫌持有相信部分来自苏宝林犯罪所得的48万1678元,无法合理说明款项来源。

2021年4月19日至25日期间,王启明被指伪造王水明与一人的借款文件,意图欺骗花旗银行,证明存入王水明户头的99万9980元的款项来源。

王启明也在2021年2月16日至8月23日期间,涉嫌提交或伪造贷款协议和多份汇款单据给花旗银行,协助名为谢玉燕和许永坤等人士隐瞒共约439万5225元的款项来源。

另外,王启明还被指在2021年10月12日删除whatsapp的对话记录,妨碍司法公正;2021年11月15日,他涉嫌在樟宜机场向移民与关卡局人员谎称遗失护照以免被扣押,实则护照当时已上交给警方。

刘凯当时是一家银行的客户经理,客户包括林宝英。他面对一项伪造文件意图欺骗的控状,指他在2020年11月24日协助林宝英,将伪造的中国税务文件提交给瑞士宝盛银行,申请在瑞士开设银行户头。

刘义杰则面对一项妨碍司法公正和一项提供假情报给公务员的罪名。控状指他涉嫌在2023年9月11日至10月5日期间,把苏炳海名下的四辆豪华车,弃置在文庆路上段第20座组屋附近的多层停车场,并向警方谎称苏炳海并未托他保管任何贵重物品。

这四辆豪华车分别是两辆劳斯莱斯和两辆法拉利。苏炳海目前正被警方通缉。

王启明和刘凯都已聘请律师,两人的律师都在庭上表示需要时间接受指示或做出陈情,申请将案件展期。刘义杰则表示有意寻求法律咨询。

刘凯在进入法院前衣着密实,身穿连帽长袖外套、戴着墨镜和口罩,直到进入庭内才摘下,以期避开媒体注意。

王启明的案件展期至9月19日,刘凯和刘义杰的案件则展期至9月12日过堂。

约9亿4400万元非法资产已被充公

这起在2023年8月侦破、涉及款项高达30亿元的洗钱案中,共有九男一女先后被治罪,法院也充公了他们约9亿4400万元的非法资产。他们服完各自的刑期后,其中八人被驱逐至柬埔寨,一人被驱逐至日本,一人被驱逐至英国。

在审理苏宝林与王水明案件的过程中,庭上曾数次提到王启明,揭露苏宝林与他串谋伪造文件欺骗渣打银行,苏宝林之后用以此骗得的65万7980元购买其他房地产。同时,王水明也通过王启明,提交伪造的中国招商银行账单给花旗银行作为证明文件。

当局自2021年10月开始调查王启明,他在这期间一直保释在外。花旗银行发言人早前答复询问时说,王启明已在2022年4月离职。(部分人名译音)

2024.8.13 a 23-year-old malaysian man, tan nian hao (“tan”), was sentenced to 56 months’ imprisonment on 7 august 2024 for carrying out fraudulent retail purchases using stolen credit card information via a mobile payment service at orchard road and other offences.

runner for criminal syndicate involved in phishing scams jailed for 56 months

a 23-year-old malaysian man, tan nian hao (“tan”), was sentenced to 56 months’ imprisonment on 7 august 2024 for carrying out fraudulent retail purchases using stolen credit card information via a mobile payment service at orchard road and other offences.

on 11 april 2024, the police were informed that unfamiliar transactions which amounted to more than $28,000 had been charged to the complainants’ bank cards. the police established the identities of tan and his accomplice. they were subsequently arrested at woodlands checkpoint when they tried to enter singapore on 16 april 2024. investigations found that this was the third time they had entered singapore together intending to commit such offences using bank cards – the details of which had been obtained via phishing scams – which had been linked to a mobile payment service. the case against tan’s accomplice is still pending.

tan was convicted of:

1.three charges of abetment by conspiracy with persons in singapore and elsewhere to cheat under section 420 read with sections 109 and 108b of the penal code 1871 (“pc”);

2.one charge of being party to a criminal conspiracy with persons in singapore and elsewhere to cheat under section 420 read with sections 120b and 108b of the pc;

3.one charge of converting property which represents another person’s benefits from criminal conduct under section 54(2)(b) which is punishable under section 54(5) of the corruption, drug trafficking and other serious crimes (confiscation of benefits) act 1992 (“cdsa”) read with sections 109 and 108b of the pc; and

4.one charge of removing from the jurisdiction property which represents another’s benefits from criminal conduct under section 54(2)(b) which is punishable under section 54(5) of the cdsa read with sections 109 and 108b of the pc.

11 other charges were taken into consideration for sentencing purposes, consisting of ten charges of abetment by conspiracy with persons in singapore and elsewhere to cheat and one charge of acquiring property that represents the accused’s benefits from criminal conduct under section 54(1)(c) which is punishable under section 54(5) of the cdsa.

anyone who is convicted of cheating shall be punished with imprisonment for a term which may extend to 10 years and shall also be liable to fine. anyone who is convicted of converting or removing from the jurisdiction property which represents another’s benefits from criminal conduct shall be liable to a fine not exceeding $500,000 or to imprisonment for a term not exceeding 10 years or to both.

the police would like to remind members of the public that unauthorised use of another person’s credit/debit card information is a serious offence and take a serious view against any person who commits such offences, including attempts to use such information. perpetrators will be dealt with in accordance with the law.

—

共谋盗用信用卡资料消费 23岁马国青年判监56月

利用钓鱼骗局盗取的信用卡资料,进行未经授权的2万8000多元零售消费,23岁男子被捕后被控上庭,被判坐牢56个月。

来自马来西亚的被告陈念浩(译音)承认三项共谋教唆欺骗罪、一项共谋欺骗罪、一项转换犯罪所得罪和一项转移犯罪所得罪。法官将另外11项控状纳入考量后,上星期三(8月7日)在国家法院作出判决。

新加坡警察部队星期二(13日)发出文告,指警方在4月11日接到有关投诉者的银行卡出现多笔未授权交易的报案,涉及的金额超过2万8000元。

警方调查后确认了被告和一名同伙的身份,并在两人于4月16日试图从兀兰关卡进入新加坡时,逮捕他们。

调查显示,这是被告和同伙第三次一同进入新加坡犯案,他们所盗用的银行卡资料,是从与手机支付服务有关的钓鱼骗局获取。

涉案同伙的案件还在审理中。

根据刑事法典,串谋欺骗罪一旦罪成,违例者可被判最高10年监禁和罚款。转换或转移犯罪所得若罪成,则可被判罚款最高50万元,判监最长10年,或两者兼施。

警方提醒公众,未经授权使用他人的银行卡资料是一个严重罪行,当局严厉看待这些违例行为,违例者将被依法处置。

—

发表回复