2024.8.4 in february 2024, the moreno valley sheriff’s station special enforcement team (set) launched an investigation into an organized retail crime and trailer cargo theft ring. on august 2, 2024, around 12:20 p.m., moreno valley sheriff’s station set deputies served a search warrant on a warehouse located in the 3400 block of de forest circle in jurupa valley. over 300 pallets of stolen merchandise, ranging from small appliances to high-end gaming computers, were seized during the service of the search warrant. deputies detained 33-year-old yong li during the search warrant. li was later arrested for receiving stolen property and an aggravated white-collar crime enhancement. this is an ongoing investigation, and no additional information is available at this time.

moreno valley station

posted on: august 4, 2024

recovery of stolen cargo

reporting deputy: sergeant miguel ramos

file # jv242150161

details:

in february 2024, the moreno valley sheriff’s station special enforcement team (set) launched an investigation into an organized retail crime and trailer cargo theft ring. on august 2, 2024, around 12:20 p.m., moreno valley sheriff’s station set deputies served a search warrant on a warehouse located in the 3400 block of de forest circle in jurupa valley. over 300 pallets of stolen merchandise, ranging from small appliances to high-end gaming computers, were seized during the service of the search warrant. deputies detained 33-year-old yong li during the search warrant. li was later arrested for receiving stolen property and an aggravated white-collar crime enhancement. this is an ongoing investigation, and no additional information is available at this time.

anyone with additional information is encouraged to contact deputy sultan at the moreno valley sheriff’s station at (951) 486-6700. as a reminder, “community policing” involves partnerships between law enforcement and community members. business owners and residents are encouraged to report criminal activity directly to law enforcement by calling sheriff’s dispatch at (951) 776–1099 or 911 if the matter is an emergency.

for media inquiries regarding this incident please contact the media information bureau.

—

deputies find hundreds of pallets of suspected stolen merchandise in warehouse in jurupa valley

hundreds of pallets carrying merchandise alleged to have been stolen were recovered friday after authorities served a search warrant on a warehouse in jurupa valley.

the search warrant was served around 12:20 p.m. on aug. 2, at the warehouse in the 3400 block of de forest circle, according to the riverside county sheriff’s department.

during the search, authorities said they located over 300 pallets of stolen merchandise, including high-end gaming computers. one person was arrested on suspicion of receiving stolen property, authorities said. that individual was identified by authorities as 33-year-old yong li.

the search warrant and arrest followed an investigation that was launched back in february by a special enforcement team within the moreno valley sheriff’s station. authorities said their investigation is still ongoing.

anyone with more information about this case was asked to call deputy sultan at the moreno valley sheriff’s station at (951) 486-6700.

—

华男收脏被捕!南加仓库发现数百托盘,疑似被盗商品!

河滨县警长办公室官员报告称,2024年2月,莫雷诺谷警长分局的特别执法团队(set)对一个有组织的零售犯罪和拖车货物盗窃团伙展开了调查,并在8月2日,在jurupa valley的一个仓库执行搜查中发现了数百个载有疑似被盗商品的托盘,其中包括高端游戏电脑。

根据河滨县警长办公室的消息,该搜查令是在8月2日下午12点20分左右,在位于德弗雷斯特圈3400号街区的仓库被执行。

在搜查过程中,当局表示他们发现了300多个托盘的被盗商品,包括高端游戏电脑。警方逮捕了一名涉嫌接收被盗财产的人员,该人员被确认是33岁的华人男子李勇(yong li)。

这次搜查令和逮捕是基于莫雷诺谷警长分局的特别执法团队自今年2月启动的一项调查。警方表示,调查仍在进行中。

警方表示,任何有更多关于此案信息的人,请联系莫雷诺谷警长分局的苏丹副警长。

—

南加州警方成功捣毁亚裔男子销赃窝点

上周五,河滨县警方打击盗销行动中,在jurupa valley成功捣毁一处大型销赃窝点,数百个满载疑似被盗商品的托盘曝光于光天化日之下,其中不乏高端游戏电脑等昂贵商品,涉案金额惊人。

8月2日正午时分,随着搜查令的正式执行,警方迅速包围了位于de forest circle 3400号街区的一处隐秘仓库。经过周密部署与突击检查,警方惊人地发现,仓库内堆满了共计300多个托盘,每个托盘上都满载着从小型家电到高端游戏电脑等各类被盗商品,场面之壮大。

而在此次行动中,一名关键人物——33岁的亚裔李永(yong li)因涉嫌收受并销售赃物被警方当场逮捕。根据指控,李永不仅面临严重的盗窃罪指控,还可能因白领犯罪加重处罚,其背后可能隐藏着一个庞大的零售犯罪与拖车货物盗窃网络。

开头我们也提到,此次突袭行动并非偶然,早在今年2月起,河滨县警察局moreno valley分局特别执法小组就以数月来深入调查、精心布局的结果,针对当地的有组织零售犯罪团伙展开了全面追踪,最终锁定了这一非法销赃仓库,并成功实施了精准打击。

2024.8.3 two men from china are accused of money laundering after police say they were found with $250,000 worth in gold bars during a traffic stop thursday on interstate 20 in van zandt county.

2 chinese nationals found with $250,000 in gold bars during i-20 traffic stop charged with money laundering

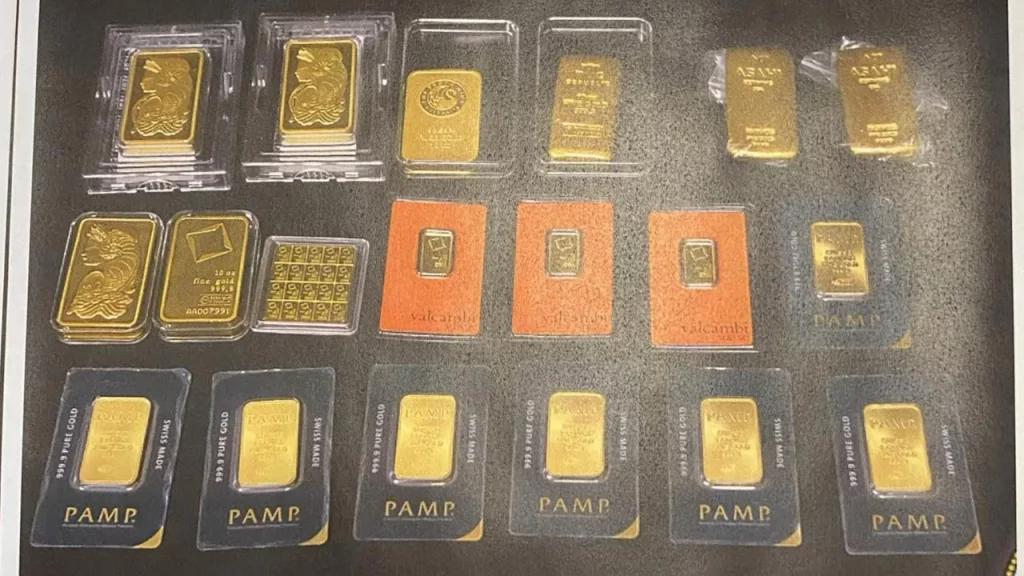

a search of the vehicle led to the detective finding a bag behind the driver’s seat with multiple pieces of gold bars inside.

canton, texas — two men from china are accused of money laundering after police say they were found with $250,000 worth in gold bars during a traffic stop thursday on interstate 20 in van zandt county.

weijian chen, 25, and wenqiang lin, 46, were arrested for money laundering between $150,000 and $300,000, according to court records. during a news conference friday, van zandt county district attorney tonda curry detailed their arrests and gave updates on the investigation.

according to an arrest document, a wills point detective pulled over the vehicle that chen and lin were riding in after he noticed the car was following another vehicle too closely. the detective asked chen, who was the driver, to speak with him at the patrol vehicle using a translation app. the officer said he believed there was criminal activity “afoot.”

chen told the detective they flew from los angeles, california to atlanta, georgia to “play,” but they were only in atlanta for a day. when asked about three bags in the vehicle, chen denied the detective’s request to search them. lin, who had rented the car, later gave permission while seeming unsure, and he said they had already been stopped by another officer, the document read.

the detective’s k-9 conducted a sniff search of the vehicle. the detective found a boarding pass for a flight from los angeles on july 30 that landed in atlanta on july 31. the search then led to the detective finding a bag behind the driver’s seat with multiple pieces of gold bars inside. the value of that gold totals about $250,000, according to the affidavit.

the affidavit said both lin and chen claimed they did not know who the bag or the gold belonged to. both men were then placed under arrest.

after contacting an agent with homeland security, the wills point detective learned lin entered the united states illegally and was encountered by u.s. border patrol on sept. 15, 2023, in california. he was given a notice to appear in court and released without having to post bail. chen came into the united states on dec. 17, 2023, in california and also given a notice to appear in court and released without having to post bail as well, the document read.

in an interview with police at the van zandt county jail, chen said he received the gold bars by someone asking him to take the gold to dallas. he didn’t give any more information. lin said he left china, went to hong kong, then flew to turkey and flew to mexico from there. lin said he then traveled through mexico with others from china to attempt entry into the u.s., the affidavit stated.

the wills point officer learned that lin and chen were stopped in monroe county, georgia, on july 31 and a law enforcement officer searched their vehicle with a narcotics detection dog at the time. that officer tried tracking where their rental vehicle had been previously. the officer found that they had used a different vehicle, which left the atlanta airport, and traveled north to marietta, georgia, which is an area known for cartel activity.

curry said she believes they were working with the cartel after investigating their travel history this week.

according to the document, they went south to jacksonville, florida and they stayed in jacksonville for about two hours before going west on interstate 10 and then north on interstate 49 to i-20, where they were later pulled over in the wills point area.

the wills point detective wrote in the document that people who are involved in criminal activity like selling illegal narcotics usually carry large amounts of money. curry said to convict them in court of money laundering, her office would have to prove that they engaged in unlawful activity.

deana brown, founder of freedom seekers international, said the main reason people leave china is because of communism. freedom seekers international helps rescue people from other countries who are persecuted for their faith and helps resettle them.

she said when migrants come to the u.s., they don’t have working permits, so some resort to other ways of making money. however, brown doesn’t believe the two men are refugees since they had money to buy a plane ticket and rent cars.

“i’m sure there are good people who are leaving horrible circumstances, but among those good are people who help organizations that prey on u.s. citizens,” curry said, adding she doesn’t know if the two men came into the u.s. as refugees.

“they were arrested for money laundering. no formal charges have been filed yet,” curry said.

—

携价值25万美金金条 两中国非法移民在美被捕

图左为现年25岁的陈伟建(weijian chen,音译),右为46岁的林文强(wenqiang lin,音译)。(美国德州范赞特县拘留中心囚犯资料库)

在德州范赞特县(van zandt)20号州际公路(i-20)的一场交通执法中,美国警方发现两名非法入境的中国男子,携带着价值约25万美元的金条,遂将两人逮捕。

目前,现年25岁的陈伟建(weijian chen,音译)和46岁的林文强(wenqiang lin,音译)都面临洗钱指控。根据范赞特县拘留中心的囚犯数据库,两人已在8月1日下午遭到拘留。

美国联邦众议员兰斯·古登(lance gooden)在社交平台x上表示:“我所在的选区有两名役龄中国籍男子被捕,罪名是洗钱,他们携带了价值约25万美元的黄金。”

综合美国媒体报导,事发时,威尔斯角警察局警佐查理·休斯(charlie hughes)正在20号州际公路沿线进行交通执法。

在靠近20号州际公路西行533英里标记处时,发现一辆密西根州注册的白色雪佛兰malibu违反交通规则。

休斯拦截了这辆汽车,经确认,肇事司机为25岁的陈伟健。由于语言障碍,休斯要求陈伟健到他的巡逻车上,并使用翻译应用程序与他交谈。

在谈话中,休斯“观察到了多种因素,导致他相信正在发生犯罪活动”。

陈伟健告诉休斯,他们从加州洛杉矶飞往乔治亚州亚特兰大“游玩”,但只在亚特兰大停留了一天。

陈伟健声称,他要去达拉斯,并准备前往佛罗里达“游玩”。

这台车辆是以林文强的名义租用的。在盘问完两人后,休斯取得了林文强的同意后,让警犬嗅探车辆,随后警犬“开始在前排乘客门缝处嗅闻,并向警员示警”。

官员车内发现了精神航空的登机证,显示陈伟建于7月30日下午5:19在洛杉矶登机。7月31日凌晨12:53抵达亚特兰大。

租赁协议显示,该车辆于7月31日凌晨1:28在乔治亚州大学公园市(college park)租用,并预计于8月3日上午11:30在洛杉矶归还。

驾驶座后面的地板上有个袋子,官员们在其中发现了多块金条,估计价值在20万至25万美元之间。

据称,这两名中国男子声称,他们不知道袋子和黄金是谁的。他们双双被捕,并被送往范赞特县监狱。

两人被捕后,休斯联系了美国国土安全部,国土安全部审查了他们的移民记录,得知两人是非法入境的。

法庭文件指出,林文强于2023年9月15日在加州特卡特(tecate)非法进入美国,收到出庭通知后,已在无需保证金的情况下获释。林文强原订于2024年9月在洛杉矶接受进一步的移民处理。

陈伟建于2023年12月17日在加州特卡特非法进入美国,收到了出庭通知后,已在无需保证金的情况下获释。其案件仍在处理中。

林文强供述,他离开中国前往香港,从那里飞往土耳其,然后飞往墨西哥。随后,他与其他中国走线者一起穿越墨西哥,试图进入美国。

休斯确认了,林、陈两人在乔治亚州,曾因交通违规被警方拦停。乔州警方也对两人产生了怀疑,并开始追踪他们的行踪,并联系了租赁公司以收集资讯。

透过租赁公司,乔治亚州警方得知,林、陈两人在遭到警方拦停后已返回该公司,并换成了另一辆车。

休斯说,乔治亚州警方透过识别该车辆确定,他们两人曾前往乔州玛丽埃塔市(marietta)一个以走私活动闻名的区域。

在上周五(8月2日)的新闻发布会上,德州州众议员吉儿·达顿(jill dutton)和范赞特县地方检察官唐妲·库里(tonda curry)也将这起犯罪活动,归咎于当前的边境政策。

库里说:“他们是在现任政府的政策下被允许入境的。”

库里表示,检方有理由相信,这些金条是透过犯罪活动取得的。她说:“这些人就是跨越美国南部边界的那种人。”

“我相信他们之中也有好人。但他们当中也有一些人在占美国人的便宜。”库里说。

库里说,刑事资产没收仍是执法的重要工具。她表示,被没收的金条,将可重新投入威尔斯角警局、地区检察官办公室、乔治亚州警局的预算中。

2024.7.31 five chinese nationals allegedly participated in a complex fraud and money laundering scheme that resulted in losses of more than $27 million to over 2,000 seniors, according to the u.s. attorney’s office. the san diego elder justice task force investigated the case. its member agencies include the u.s. attorney’s office, federal bureau of investigation, san diego county district attorney’s office, carlsbad police department, san diego police department and the california highway patrol. during a coordinated law enforcement operation wednesday in los angeles and las vegas, about 60 federal, state and local law enforcement officials arrested four defendants – zhao wang, 40, of henderson, nev.; jiandong chen, 40, of pomona; jun li, 40, of west covina, and xin wang. 36, of san gabriel – while searching their homes. the fifth defendant, youfei gong, 29, arrested on april 9 at his home in san gabriel, is being held on state charges. according to the indictment and court documents, the five defendants and their co-conspirators operated a multinational organized fraud ring targeting elderly victims throughout the u.s. from 2021 through june of this year.

press release

five chinese nationals indicted for scamming seniors out of more than $27 million

wednesday, july 31, 2024

for immediate release

u.s. attorney’s office, southern district of california

news release summary – july 31, 2024

san diego – an indictment was unsealed today alleging that five individuals participated in a massive, complex fraud and money laundering scheme that resulted in losses of more than $27 million to over 2,000 seniors.

during a coordinated law enforcement operation this morning in los angeles, california and las vegas, nevada, about 60 federal, state and local law enforcement officials arrested four of the defendants—zhao wang of henderson, nevada; jiandong chen of pomona, california; jun li of west covina, california; and xin wang of san gabriel, california—and searched their homes. the fifth defendant, youfei gong, was arrested on april 9, 2024, at his home in san gabriel, california and was in custody on state charges.

according to the indictment and publicly filed documents, the five defendants and their co-conspirators operated a multinational organized fraud ring targeting elderly victims throughout the united states.

the indictment said conspirators contacted victims through unsolicited pop-up ads, emails and phone calls designed to get victims to contact scam call centers in india. the conspirators used social engineering techniques to build trust with victims. in many cases, the conspirators had victims install remote desktop software that the conspirators used to gain remote access to victims’ computers. after building trust with a victim based on fraudulent pretenses, the conspirators used technical support, government impersonation, bank impersonation and/or refund scams to induce victims to send money to other members of the conspiracy, including the five defendants charged in the indictment.

at the direction of conspirators, victims sent wire transfers or cash in express mail packages to locations throughout southern california, nevada and elsewhere. the defendants provided fake names and addresses corresponding with retail locations, including cvs pharmacy locations, where packages were picked up. the defendants and co-conspirators picked up money-laden packages using fake ids.

according to the indictment, the defendants specifically targeted elderly americans. after receiving the victims’ money, the defendants laundered it through cryptocurrency transactions to their india-based co-conspirators. as defendant xin wang stated in a text message:

what i do is picking up packages from cvs with a fake id.[the packages] contain cash. laundering money for indian scam syndicate(s).large syndicate(s). my bosses launder over one million us dollars in a week.

xin wang describing the conspiracy in an august 18, 2023 text.

the fbi uncovered the multinational conspiracy showing the coordination between the defendants in the united states and their india-based co-conspirators who were in direct contact with victims. between just 2021 to 2023, agents identified approximately 2,000 victims who lost more than $27 million to the conspirators. the indictment said the conspiracy continued through june 2024.

“every day swindlers entangle unsuspecting seniors into scams to steal their hard-earned savings,” said u.s. attorney tara mcgrath. “we urge everyone to use caution and consult with others before sending money to strangers they know only through phone calls, texts, or a computer.”

“southern california is sadly a target rich environment for foreign and domestic scam artists who relentlessly prey on vulnerable americans and their bank accounts,” said akil davis, the assistant director in charge of the fbi’s los angeles field office. “today’s arrests follow hard work by many dedicated law enforcement agencies and will aid our continuing efforts to educate potential victims to avoid responding to strangers who claim to care about them, and never give or send hard-earned money in response to a solicitation.”

“fbi san diego elder justice task force, along with fbi la, has worked tirelessly to bring justice to individuals who target, exploit, and victimize our most vulnerable citizens,” said stacey moy special agent in charge for the federal bureau of investigation san diego field office. “the fbi remains resolute in our commitment to disrupt and dismantle foreign-based fraud schemes that prey on our older americans. we will continue to work side by side with our law enforcement partners to deter and defeat organized fraud rings, no matter where they are located.”

this case was investigated by the san diego elder justice task force and its member agencies, including the u.s. attorney’s office, federal bureau of investigation, san diego county district attorney’s office, carlsbad police department, san diego police department, and the california highway patrol.

if you or someone you know is age 60 or older and has been a victim of financial fraud, help is available through the national elder fraud hotline: 1-833 fraud-11 (1-833-372-8311). you can also report fraud to any local law enforcement agency or on the fbi’s internet crime complaint center at www.ic3.gov.

this case is being prosecuted by assistant u.s. attorney kevin mokhtari.

defendants case number 24cr1317-rsh

zhao wang, aka “oscar” age: 40 henderson, nv

jiandong chen, aka “little tiger” age: 40 pomona, ca

jun li age: 40 west covina, ca

xin wang age: 36 san gabriel, ca

youfei gong age: 29 san gabriel, ca

summary of charges

conspiracy to commit mail and wire fraud – title 18, u.s.c., sections 1349, 2326

maximum penalties: forty years in prison; $1 million fine

conspiracy to launder monetary instruments – title 18, u.s.c., sections 1956(a)(1)(a)(i), 1956(a)(1)(b)(i) and 1956(h)

maximum penalties: twenty years in prison; maximum fine of $500,000 or twice the amount laundered

criminal forfeiture – title 18, u.s.c., sections 981(a)(1)(c), 982(a)(1), 982(a)(2)(a), 2328 and title 28, u.s.c., section 2461(c)

investigating agencies

federal bureau of investigation

federal deposit insurance corporation – office of inspector general

homeland security investigations

san diego county district attorney’s office

san diego county sheriff’s department

san diego police department

san diego elder justice task force

chino police department

coronado police department

escondido police department

glendora police department

long beach police department

orange county sheriff’s department

—

5中國公民涉詐騙逾2700萬 2人來自聖蓋博

31日,美國司法部公佈的一份起訴書稱,5名中國公民涉嫌參與了一項大規模、複雜的欺詐和洗錢計畫,導致2,000多名老年人上當受騙,損失多達2,700多萬美元。這5名被告中,4人來自南加州,其中2人來自聖蓋博。如罪名成立,將面臨最高刑期40年,罰款100萬美元。

聲明指出,在洛杉磯和拉斯維加斯的一次協同執法行動中,約60名聯邦、州和地方執法人員逮捕了其中4名被告。他們分別是內華達州40歲的zhao wang(又名oscar)、波莫納市40歲的jiandong chen(又名little tiger)、西科維納市40歲的jun li、聖蓋博市36歲的xin wang。調查人員搜查了他們的住所。第5名被告是29歲的youfei gong,於今年4月9日在聖蓋博家中被捕,並因州指控被拘留。

根據起訴書和公開檔,這5名被告和印度同謀在全美各地運營著一個專門以美國老年人為目標的跨國詐騙團夥。

在騙局中,受害者按照詐騙分子的指示,將現金通過電匯至南加州、內華達州等地,或直接用包裹寄出。騙子提供了虛假姓名和與郵寄地址,並使用假身份證取走裝滿現金的快遞。在收到受害者的錢後,他們通過加密貨幣交易這種洗錢方式將贓款轉給印度同夥。

檢方稱,被告xin wang在短信中承認,自己用假id從cvs取走快遞,快遞裏裝著現金。然後再把錢洗給印度詐騙集團,那是一個大型詐騙集團,老闆每個月能洗走100萬美元。

聯邦調查局(fbi)偵破了這起跨國案件,揭露了美國被告和印度同夥之間的協作和套路。在2021年至2023年間,聯邦特工就確認了約2000名受害者,他們受騙損失超過2700萬美元。這一騙局一直持續到2024年6月。

聯邦檢察官tara mcgrath說:“每天都有騙子將毫無戒備的老年人捲入騙局,騙取他們辛苦賺來的積蓄。我們呼籲民眾給網上認識的人匯款一定要謹慎,並詢問家人朋友的意見。”

fbi洛杉磯處副局長akil davis指出,南加州是跨國詐騙的高發地,詐騙分子無情地掠奪著受害者的銀行帳戶,fbi將繼續幫助潛在受害者免遭那些陌生人騙走他們辛苦賺來的錢。

此案由聖地牙哥老年司法工作組及其成員機構聯合調查,包括美國檢察官辦公室、聯邦調查局、聖地牙哥縣檢察長辦公室、卡爾斯巴德警局、聖地牙哥警局和加州高速公路巡警。

2024.7.17 zhenyong weng, of brooklyn, ny, has been arrested for allegedly targeting an 82-year-old silver spring woman through a government-imposter-related gold bar scam.

new york man charged for targeting maryland woman in gold bar scam

montgomery county, md. (7news) — a new york man is facing charges after targeting a silver spring, maryland woman in a gold bar scam, according to montgomery county police.

in may 2024, the woman was contacted by an unknown person who directed her to transfer her assets into gold bars to prevent russia from taking her money, according to officials.

the woman complied and handed the person several packages worth over $900,000 in gold bars, officials said.

on monday, july 15, around 5:22 p.m., zhenyong weng, 19, of brooklyn, ny was arrested in silver spring as he attempted to collect a package from the woman worth over $70,000, according to officials.

the arrest came during an operation conducted by montgomery county officers working with the financial crimes section.

weng is being held without bond at the montgomery central processing unit, officials said.

officials believe there could be additional victims. anyone with information is urged to call 1-866-411-8477 or share a tip online here.

—

据蒙哥马利县警方称,一名纽约男子因针对马里兰州银泉市一名女子实施金条诈骗而面临指控。

据官员称,2024 年 5 月,一名身份不明的人联系了这名女子,指示她将资产转移到金条中,以防止俄罗斯拿走她的钱。

官员称,这名女子遵从了命令,并递给该男子几包价值超过 90 万美元的金条,该男并试图再窃取约 250 万美元。

据警方透露,7 月 15 日星期一下午 5 点 22 分左右,来自纽约布鲁克林的 19 岁男子 zhenyong weng 在银泉市被捕,当时他正试图从这名女子手中收取一个价值超过 7 万美元的包裹。

—

19-year-old held without bond in gold bar scam

zhenyong weng, of brooklyn, ny, has been arrested for allegedly targeting an 82-year-old silver spring woman through a government-imposter-related gold bar scam.

according to court documents, barbara lampe fell victim to the scam, which resulted in the theft of over $900,000 and an attempt to steal an additional approximately $2,500,000.

the victim explained that while using her computer, she received an alert on the monitor directing her to call a phone number. the website alert falsely informed the victim that the criminal had flagged her computer, bank account, and social security number. the victim called the number directly and was told by the unknown suspect caller that many people were affected by the problem and that she needed to secure her money.

believing her finances were in danger, the victim followed the suspect’s instructions. on or around april 22, 2024, an unknown suspect using the name “tracy” called the victim and directed her to transfer $46,000 to coopaa fashionable to prevent russia from stealing it from her account. the victim followed the instructions and electronically transferred the funds to another account, where they were stolen, according to the documents.

on monday, july 15, 2024, at approximately 5:22 p.m., weng was arrested in silver spring while he attempted to collect a package from the victim valued at over $70,000. the arrest was conducted by montgomery county police 1st district officers working in conjunction with the financial crimes section and the violent crimes information center (vcic).

detectives believe there may be additional victims and want to remind the community that law enforcement will never attempt to contact you in this manner.

weng is being held without bond at the montgomery county central processing unit.

anyone with information regarding this crime is asked to visit the crime solvers of montgomery county, md website at www.crimesolversmcmd.org and click on the www.p3tips.com link at the top of the page or call 1-866-411-8477. a reward of up to $10,000 is offered for information leading to the suspect’s arrest. tips may remain anonymous.

for additional information regarding frauds and scams or how to report a situation, please visit https://www.montgomerycountymd.gov/pol/fraud/financial-crimes-section.html.

—

gold bar scammers bilk nearly $1m from maryland woman, police say

gold bar fraud trend involves parcels of precious metals, parking lot meet-ups and fake federal agents.

for the second time in four months, police in maryland say, fraudsters running a complicated scam involving gold bars bilked a montgomery county resident out of more than $780,000.

the man charged in the new case, zhenyong weng, 19, was ordered held without bond tuesday.

“a major crime in my eyes,” montgomery district judge aileen oliver said. “it’s stealing from a senior citizen at a time in their life when they need financial support.”

investigators accused weng of being a “courier” in a scam that set up furtive gold bar exchanges in parking lots and used code words like “watermelon” to communicate. the group took more than $900,000 in gold bars and money from their target — an 82-year-old woman — and nearly got another $2.6 million, according to court filings. as in the earlier case, police said, investigators learned of the fraud scheme, turned the tables on the alleged scammers by disguising themselves as a victim and arrested a suspect after he pulled into a parking lot thinking he was getting more gold bars. there is no indication from court filings that the cases are related.

weng’s defense attorney, while arguing tuesday his client should be released from jail pending further court proceedings, noted his client was accused only of trying to make a pickup. “it’s certainly not that a $900,000 fraud scheme of an 82-year-old in montgomery county isn’t serious conduct,” said the attorney, andrew treske, “i think the question is, ‘what was mr. weng’s involvement?’”

treske said there is no indication weng set up the scam or communicated with the mastermind behind it.

the judge questioned how he’d be in the dark.

“so he drove from new york down here to pick up a package from an elderly woman and doesn’t know there’s probably something illegal going on?” oliver wondered. “i don’t know.”

in court filings, investigators described the scam much like one in march that resulted in a resident of montgomery county’s leisure world community getting bilked out of $789,000.

in the new case, the woman was working at her computer when she received a “website alert” claiming that “criminals had flagged her computer, bank account, and social security number,” investigators wrote in court papers. she called a provided number and was told that many others had also been hit and she needed to secure her money. around april 22, police say, a person from the group using the name “tracy” convinced the victim to transfer $46,000 into another account “to prevent russia from stealing it,” investigators asserted. the scammers later persuaded her to purchase gold bars from legitimate precious-metal dealers and have them sent to her home.

in court filings, detectives described the ruse broadly as a “government impostor scam,” whereby fraudsters pretend to be officials from the fbi, department of justice, treasury department, federal trade commission or other agencies. they convince targets their bank holdings aren’t safe and they should liquidate into gold bars, cashiers checks or cash itself. once gold bars arrive at the victim’s homes, the scammers convince their targets to hand them over — doing so in meetings cloaked in secrecy because of the supposed criminals moving in on them — all with the understanding the targets will get their holdings back when things are safe.

“doctors, lawyers, executives. i’ve seen pretty much any victim,” fbi supervisory special agent keith custer said of gold bar and related scams, adding, “once the victim is on the hook, the scammer will keep going.”

in the case involving weng, police say, a man posing as an “undercover agent” met the victim at a wendy’s restaurant on may 3 and took possession of $266,948.75 worth of gold bars. the scammers then convinced her to buy several hundred thousand dollars more in gold bars, met her at a shopping center, and stole it, according to police.

still on the hook, and still scared she would lose her savings if she didn’t act, the woman purchased $2.55 million more in gold bars from a company based in massachusetts. but she grew suspicious, police say, and the new gold orders were stopped before they were shipped. as the woman began working with detectives, she spoke with the scammers, according to court records. the courier eventually agreed to pick up a gold bar from her, valued at about $75,000, on july 15.

but the courier was instead heading into a sting operation, police say.

a detective “portrayed herself as the victim and placed a cardboard box, which was said to contain the gold bar, in the rear passenger seat of the victim’s vehicle,” according to charging documents.

the detective then drove to an arranged meeting spot, parked, and waited for a man to show up. he did so, saying the code word “watermelon,” and opened a rear door, grabbed the box and left — only to be quickly arrested by plainclothes officers who had the parking lot under surveillance, court documents said.

weng was interviewed by detectives, “and made admissions that he was to meet the victim to pick up a package and was to get paid $500 to $1,000,” police said.

while being booked into jail, weng said he was born in china, lived with his mother in brooklyn and had been there for seven years. he said he worked as a server as a chinese restaurant. in court tuesday, a corrections official said weng would not provide his parents’ contact information because he didn’t want them to be called.

in the earlier case, wenhui sun, who was first arrested in march, was indicted on may 2 by a montgomery county grand jury on four theft-related counts, according to court records. he remains held on no bond and has a dec. 2 trial date set.

sun’s attorney, andrew jezic, declined to comment tuesday

montgomery police detective sean petty, a financial crimes investigator, said the county’s relative wealth may play a role in residents being targeted. he said the victims tend to be older, trusting, and have saved a lot of money. his advice: “if anyone contacts you via text message, email, phone call, or by any other means and says that they are with any federal/state agency and you need to purchase gold for safekeeping, you should immediately think that this is a scam.”

and when in doubt, he added, call the police.

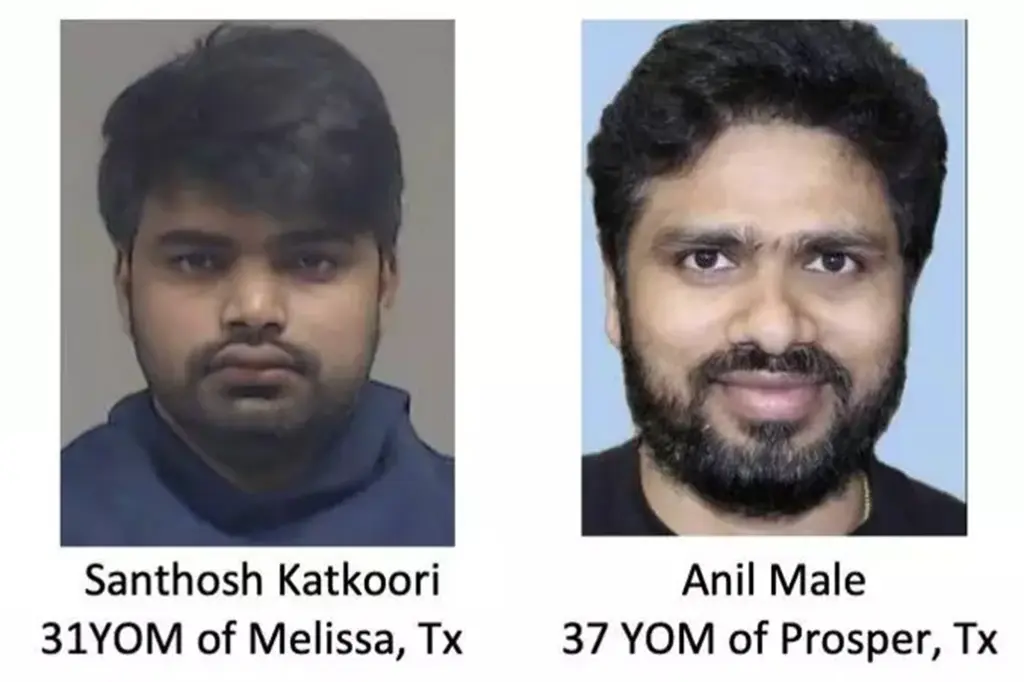

2024.7.8 four persons from the telugu states of andhra pradesh and telangana were arrested in collin county, texas, united states, on monday on charges of alleged trafficking of people, a second-degree felony which would make them liable for prison for up to 20 years. those arrested were identified as chandan dasireddy, 24, dwaraka gunda, 31, santhosh katkoori, 31, and anil male, 37, the princeton police department posted a release on its website on monday.

four from a.p., telangana held for human trafficking in u.s.

four persons from the telugu states of andhra pradesh and telangana were arrested in collin county, texas, united states, on monday on charges of alleged trafficking of people, a second-degree felony which would make them liable for prison for up to 20 years.

those arrested were identified as chandan dasireddy, 24, dwaraka gunda, 31, santhosh katkoori, 31, and anil male, 37, the princeton police department posted a release on its website on monday.

further charges of multiple parties are still pending as the investigation is underway, it stated.

according to the police, the case came to light on march 13, when a pest-control worker who attended a service on ginsburg lane saw more than a dozen women living in the same house. the young women were sleeping on the floor, there was no furniture, but had many computers and printers.

after an initial report, the princeton police searched the house of santhosh katkoori and found 15 women. various devices and documents were seized. and as the investigation progressed, other locations such as melissa and mckinney were also found to have harboured victims, including men. more devices and documents were seized and analysed, the release said.

as per the investigation, the police disclosed that the women were forced to work for santhosh katkoori and his wife dwaraka gunda for multiple programming shell companies owned by them.

—

15 women rescued from collin county trafficking operation after tip from pest control company

police say both women and men were forced to work as programmers for a couple’s shell companies

four people were arrested and charged as part of a human trafficking bust in princeton. nbc 5’s alanna quillen has the details.

police in princeton on monday announced they’d uncovered a large labor trafficking operation in collin county earlier this spring while responding to a welfare call.

according to an arrest affidavit obtained by nbc 5, princeton police said a pest control company called to treat bed bugs at a home on the 1000 block of ginsburg lane on march 13 reported a “suspicious circumstance” and requested a welfare check.

during the investigation into the report, princeton police obtained a search warrant for santhosh katkoori’s home. once inside the house, police discovered 15 adult women who they said were forced to work for several shell companies owned by katkoori and his wife, dwaraka gunda.

investigators said the victims, which included both women and men, were working as programmers and that during the search of the home on ginsburg lane, several laptops, phones, printers, and fraudulent documents were seized.

princeton police said they later learned multiple locations in the cities of princeton, melissa, and mckinney were involved in the forced labor operation and that they later seized more laptops, phones, and documents from other locations.

the police statement did not include the addresses of those other locations or details about the nature of the programming work done for the couple’s alleged shell companies.

an arrest affidavit obtained by nbc 5 said princeton police were tipped off to the operation by arrow pest control who had been called to the house to treat bed bugs. after leaving the house, the technician reported what he saw inside the home, and that information was relayed to the police. in an interview with detectives, the tech confirmed he’d seen 15-20 young women sleeping on bed rolls in various rooms. he also said he saw many suitcases in the living area and no furniture in the home other than folding tables.

according to the affidavit, the women inside the home later told police they were brought to princeton for an “internship” where they would apply for jobs and learn javascript. police said once the girls obtained a job, the money from those jobs went directly to the homeowner’s company. the homeowner, police said, held back 20% of the money the women earned and then gave them the remainder.

princeton police said monday, after investigators conducted an analysis of all of the electronics seized and the nature of the operation was confirmed, they issued arrest warrants for four people now charged with trafficking of persons, a second-degree felony.

police identified the suspects as 31-year-old santhosh katkoori, of melissa; 31-year-old dwaraka gunda, of melissa; 24-year-old chandan dasireddy, of melissa; and 37-year-old anil male, of prosper. it’s unclear if any of the four charged have obtained attorneys to speak on their behalf.

princeton police said further charges of multiple parties are still pending as this investigation continues. anyone with information about the labor trafficking operation or who was a victim of human/labor trafficking is asked to call the princeton police department at 972-736-3901 or dial 911 immediately.

—

15 women found sleeping on floor of bare texas home were trafficked for ‘forced labor’: police

four people have been arrested in texas for running a “forced labor” scheme from an unassuming home on a quiet block, leaving neighbors stunned.

fifteen women were found living in a home in princeton — about 45 miles northeast of downtown dallas — following a welfare check where they were forced to sleep on the floor when they weren’t working, according to fox 4 news.

there was essentially no furniture in the home — just blankets and a bunch of computers and other electronics, police said in an announcement monday.

the women were reported to police by a pest control company that was called to the home for bedbugs, according to an affidavit obtained by the outlet.

the inspector noted that “each room… had 3-5 young females sleeping on the floors” and said there were “large amounts of suitcases.”

chandan dasireddy, 24; dwaraka gunda, 31; santhosh katkoori, 31 — all of melissa, texas — and anil male, 37, of prosper were arrested in march and charged with human trafficking.

police said the women were forced to work for katkoori and several programming shell companies owned by him and his wife, gunda.

a search of the home revealed several laptops, cell phones, printers and fraudulent documents.

investigators later learned that the forced labor operation included multiple locations in princeton, melissa and kckinney with dozens of victims — including adult males. additional electronics and documents were seized from other locations.

princeton police dept.

princeton police dept.

princeton police sgt. carolyn crawford told fox 4 that “over 100” people were involved — more than half of whom are victims.

more arrests are expected, cops said.

“how we came across this situation was very unique,” princeton police chief james waters said. “[investigators] would unravel just a multitude of other clues and a multitude of other scenes that was going out there.”

the neighborhood is shocked such an operation was happening on their street.

“i would’ve never thought that something like this was going on like a few houses down from mine,” neighbor herbert logan said.

another neighbor, steven watkins, said he had “no idea about anything.”

“what was going on before we even moved in here? it’s kind of really dark to think about,” he said.

police would not disclose where the victims are from or if they ever tried to escape.

—

周一,四名来自泰卢固语邦安得拉邦和特伦甘纳邦的嫌疑人因涉嫌贩卖人口在美国德克萨斯州科林县被捕,这是一项二级重罪,最高可判处 20 年监禁。

普林斯顿警察局周一在其网站上发布了一份声明,称被捕人员分别为 24 岁的 chandan dasireddy、31 岁的 dwaraka gunda、31 岁的 santhosh katkoori 和 37 岁的 anil male。

据警方介绍,该案于3月13日被曝光,当时一名在金斯伯格巷参加服务活动的害虫防治工人发现同一栋房子里住着十几名女性。这些年轻女性睡在地板上,没有家具,但有很多台电脑和打印机。

接到初步报告后,普林斯顿警方搜查了桑托什·卡特库里的家,发现了 15 名女性。警方缴获了各种设备和文件。随着调查的深入,警方还发现梅利莎和麦金尼等其他地点也窝藏了受害者,其中包括男性。新闻稿称,警方缴获并分析了更多设备和文件。

根据调查,警方透露,这些女子被迫为桑托什·卡特库里 (santhosh katkoori) 和他的妻子德瓦拉卡·贡达 (dwaraka gunda) 拥有的多家编程空壳公司工作。

2024.6.27 the justice department today announced the 2024 national health care fraud enforcement action, which resulted in criminal charges against 193 defendants, including 76 doctors, nurse practitioners, and other licensed medical professionals in 32 federal districts across the united states, for their alleged participation in various health care fraud schemes involving approximately $2.75 billion in intended losses and $1.6 billion in actual losses.

press release

national health care fraud enforcement action results in 193 defendants charged and over $2.75 billion in false claims

thursday, june 27, 2024

for immediate release

office of public affairs

the justice department today announced the 2024 national health care fraud enforcement action, which resulted in criminal charges against 193 defendants, including 76 doctors, nurse practitioners, and other licensed medical professionals in 32 federal districts across the united states, for their alleged participation in various health care fraud schemes involving approximately $2.75 billion in intended losses and $1.6 billion in actual losses.

in connection with the coordinated nationwide law enforcement action, and together with federal and state law enforcement partners, the government seized over $231 million in cash, luxury vehicles, gold, and other assets.

“it does not matter if you are a trafficker in a drug cartel or a corporate executive or medical professional employed by a health care company, if you profit from the unlawful distribution of controlled substances, you will be held accountable,” said attorney general merrick b. garland. “the justice department will bring to justice criminals who defraud americans, steal from taxpayer-funded programs, and put people in danger for the sake of profits.”

“the extraordinary special agents of homeland security investigations (hsi) were proud to play an integral role in this multi-agency investigation and national takedown of healthcare fraud,” said secretary of homeland security alejandro n. mayorkas. “through this action, we in federal law enforcement send a clear and strong message—that we will hold accountable those health care providers and prescribers who prey on their patients for profit and disregard the first rule of medical care: do no harm.”

“healthcare fraud victimizes patients, endangers the health of vulnerable people, and plunders healthcare programs,” said fbi director christopher wray. “this wide-ranging collaboration demonstrates the fbi’s commitment to rooting out predatory healthcare fraud, protecting patients, and ensuring critical healthcare funds go where they are needed most.”

the charges alleged include over $900 million fraud scheme committed in connection with amniotic wound grafts; the unlawful distribution of millions of pills of adderall and other stimulants by five defendants associated with a digital technology company; an over $90 million fraud committed by corporate executives distributing adulterated and misbranded hiv medication; over $146 million in fraudulent addiction treatment schemes; over $1.1 billion in telemedicine and laboratory fraud; and over $450 million in other health care fraud and opioid schemes.

“health care fraud affects every american,” said principal deputy assistant attorney general nicole m. argentieri, head of the justice department’s criminal division. “it siphons off hard-earned tax dollars meant to provide care for the vulnerable and disabled. in doing so, it also raises the cost of care for all patients. even worse, as the prosecutions we announce today underscore, health care fraud can harm patients and fuel addiction. the criminal division is committed to rooting out health care fraud, wherever it may be found, no matter who commits it. and we are using more tools than ever before to uncover misconduct and hold wrongdoers to account, whether they are executives in corner offices or doctors who violate their oaths.”

today’s enforcement action was led and coordinated by the health care fraud unit of the criminal division’s fraud section and its core partners: u.s. attorneys’ offices, the department of health and human services office of inspector general (hhs-oig), fbi, and drug enforcement administration (dea). the cases were investigated by agents from the division’s core partner agencies along with other federal and state law enforcement agencies. the cases are being prosecuted by health care fraud strike force teams from the criminal division’s fraud section, 32 u.s. attorneys’ offices nationwide, and 11 state attorney generals’ offices.

“this work is important to the department of health and human services (hhs) and the millions of americans we serve. hhs vigorously pursues anyone who commits fraud against our health care programs. but it takes all of us, working together, to be successful,” said hhs deputy secretary andrea palm. “those who steal from these programs are stealing from the american families who rely on them and putting patients at risk. we won’t stop until all those who try to defraud the federal government are caught and held accountable.”

“we will not tolerate fraud that preys on patients who need and deserve high quality health care,” said the hhs-oig inspector general christi a. grimm. “the hard work of the hhs-oig team and our outstanding law enforcement partners makes today’s action possible. we must protect taxpayer dollars and keep americans safe from harms to their health, privacy, and financial well-being.”

amniotic wound grafts

charges were filed in the district of arizona against four individuals who allegedly filed $900 million in false and fraudulent claims to medicare for amniotic wound grafts used on medicare patients. as alleged, the defendants targeted elderly medicare patients, many of whom were terminally ill. the defendants caused medically unnecessary and expensive amniotic grafts to be applied to these vulnerable patients’ wounds indiscriminately, without coordination with the patients’ treating physicians and without proper treatment for infection, to superficial wounds that did not need this treatment, and in sizes that far exceeded the size of the wound. in just 16 months, medicare paid two defendants more than $600 million as a result of their fraud scheme, paying on average more than a million dollars per patient for these unnecessary grafts. these two defendants owned wound care companies in arizona and received more than $330 million in illegal kickbacks in exchange for purchasing the grafts billed to medicare. in connection with the charges, the government seized over $70 million, including four luxury vehicles, gold, jewelry, and cash.

“every dollar saved by investigating fraud is critical to the sustainability of the medicare program and the needs of the people who depend on it,” said administrator chiquita brooks-lasure of the centers for medicare & medicaid services (cms). “in addition to the actions taken by the justice department, cms took 127 administrative actions in the last six months separately against providers for their alleged involvement in health care fraud schemes. we thank our partners at the department of justice and department of health and human services office of inspector general for working closely with us to identify, investigate, and eliminate waste, fraud, and abuse in our federal health care programs.”

distribution of adderall and other stimulants

five additional defendants associated with digital technology company done global inc. and its affiliated entity, done health p.c. (collectively, “done”), were charged for the unlawful distribution of millions of adderall pills. the ceo and clinical president of done were charged on june 13 in a scheme to distribute adderall and other stimulants over the internet. the charges announced today include those against one of the most prolific prescribers working for done, a florida nurse practitioner who prescribed over 1.5 million pills of adderall and other stimulants to patients across the united states. the indictment alleges that the nurse practitioner prescribed adderall and other stimulants without interaction with patients, pursuant to done’s “auto-refill” policy. this policy allowed patients to obtain continued prescriptions after an initial encounter without any further audio or visual interaction with a medical professional. this allegedly resulted in the nurse practitioner prescribing adderall and other stimulants to individuals suffering from drug addiction and continuing to issue adderall prescriptions for months after the overdose deaths of patients.

“dea works tirelessly to protect the public from harm, be it cartels funneling fentanyl into our communities or medical providers caring more about profits than patients,” said dea administrator anne milgram. “the ceo and clinical director of done global inc. are charged with over-prescribing millions of unneeded stimulant pills, potentially putting patients in danger and exacerbating the current stimulant medicine shortage. the seriousness of these actions should not be understated. dea will continue to hold anyone accountable who endangers the health and well-being of americans.”

diverted hiv medication

three owners and executives of a wholesale distributor of pharmaceutical drugs were charged in connection with an alleged $90 million wire fraud conspiracy to introduce adulterated and misbranded hiv drugs into the market. the hiv drugs were allegedly acquired through unlawful “buyback” schemes in which previously dispensed bottles of prescription drugs were bought from vulnerable patients. the defendants allegedly purchased these drugs from the black market and resold them to pharmacies throughout the country with falsified documentation designed to conceal the true source of the medication. pharmacies then dispensed these diverted hiv medications to unsuspecting patients. at times, patients received bottles labeled as their prescription medication, but the bottles contained a different drug entirely, with one patient passing out and remaining unconscious for 24 hours after taking an anti-psychotic drug thinking it was his prescribed hiv medication.

addiction treatment cases

the addiction treatment cases announced today include charges filed in the district of arizona and southern district of florida against four defendants in connection with more than $146 million of allegedly false and fraudulent claims for services for vulnerable patients seeking treatment for drug or alcohol addiction. as alleged in one of the indictments, one defendant paid kickbacks in exchange for the referral of patients recruited from the homeless population and native american reservations. she then fraudulently billed arizona medicaid for substance abuse treatment services that were either never provided or were provided at a level that was so substandard that it failed to serve any treatment purpose. the defendant is charged with money laundering offenses for her lavish purchases with the fraud proceeds, as well as obstruction of justice for allegedly falsifying records in response to a grand jury subpoena for documents.

telemedicine and laboratory fraud cases

thirty-six defendants were charged in connection with the submission of over $1.1 billion in fraudulent claims to medicare resulting from telemedicine schemes. for example, in separate cases involving similar schemes that were perpetrated by different criminal networks in the southern district of texas, northern district of texas, and district of new jersey, clinical laboratory owners allegedly paid illegal kickbacks and bribes, including to telemedicine companies, in exchange for the referral of orders for unnecessary genetic testing. the results of these genetic tests—which were supposed to detect genetic mutations that could indicate an elevated risk of cancer, cardiovascular disease, parkinson’s disease, and other serious illness—were not used in the patients’ treatment. other telemedicine schemes included the unsealing of a complaint in the eastern district of virginia against a psychiatrist who allegedly submitted fraudulent claims based on minimal patient interactions, including for visits that lasted between 10 to 30 seconds. the continued focus on prosecuting health care fraud schemes involving telemedicine reflects the department’s commitment to rooting out these schemes, which has saved taxpayers billions of dollars.

cases involving the illegal prescription and distribution of opioids and other health care fraud schemes

the other cases announced today charge 14 defendants with crimes related to the illegal prescription and distribution of opioids that resulted in millions in false billings, including several charges against medical professionals and others who prescribed unnecessary opioids, suboxone, and other controlled substances.

an additional 126 defendants are charged with various other health care fraud schemes involving over $450 million in false and fraudulent claims to medicare, medicaid, and private insurance companies for treatments that were medically unnecessary or never provided. ten defendants across the country were charged in connection with fraudulent covid-19 testing, including an over $65 million scheme charged in the southern district of florida.

the center for program integrity of the centers for medicare and medicaid services (cpi/cms) separately announced today that it took adverse administrative actions in the last six months against 127 medical providers for their alleged involvement in health care fraud.

principal assistant deputy chief jacob foster, assistant chief rebecca yuan, and trial attorney miriam l. glaser dauermann of the health care fraud unit of the criminal division’s fraud section led and coordinated today’s enforcement action. the cases are being prosecuted by the health care fraud unit’s national rapid response, florida, gulf coast, los angeles, midwest, northeast, and texas strike forces; u.s. attorneys’ offices for the southern district of alabama, district of arizona, central district of california, northern district of california, southern district of california, district of connecticut, middle district of florida, southern district of florida, northern district of illinois, eastern district of kentucky, western district of kentucky, eastern district of louisiana, middle district of louisiana, western district of louisiana, eastern district of michigan, western district of michigan, southern district of mississippi, district of montana, district of new jersey, eastern district of new york, eastern district of north carolina, western district of oklahoma, district of rhode island, eastern district of tennessee, middle district of tennessee, eastern district of texas, northern district of texas, southern district of texas, eastern district of virginia, western district of virginia, southern district of west virginia, and eastern district of wisconsin; and state attorney generals’ offices for arizona, california, illinois, indiana, louisiana, new york, oklahoma, pennsylvania, puerto rico, rhode island, and south dakota. the health care fraud unit’s data analytics team used cutting-edge data analytics to identify and support the investigations that led to these charges.

in addition to the fbi, hhs-oig, dea, and cms/cpi, hsi, irs criminal investigation, department of veterans affairs office of inspector general, defense criminal investigative service, department of labor, united states postal service office of inspector general, and other federal, state, and local law enforcement agencies participated in the operation. the medicaid fraud control units of the states of arizona, california, connecticut, florida, illinois, indiana, kentucky, louisiana, new york, north carolina, oklahoma, pennsylvania, puerto rico, rhode island, south dakota, tennessee, texas, and virginia also participated in the investigation of many of the federal and state cases announced today.

the fraud section leads the criminal division’s efforts to combat health care fraud through the health care fraud strike force. prior to the charges announced as part of today’s nationwide enforcement action and since its inception in march 2007, the health care fraud strike force, which operates in 27 districts, charged more than 5,400 defendants who collectively billed medicare, medicaid, and private health insurers more than $27 billion.

https://www.justice.gov/opa/pr/national-health-care-fraud-enforcement-action-results-193-defendants-charged-and-over-275-0

https://www.justice.gov/criminal/criminal-fraud/health-care-fraud-unit/2024-national-hcf-case-summaries

—

justice department charges nearly 200 people in $2.7 billion health care fraud schemes crackdown

washington (ap) — nearly 200 people have been charged in a sweeping nationwide crackdown on health care fraud schemes with false claims topping $2.7 billion, the justice department said on thursday.

attorney general merrick garland announced the charges against doctors, nurse practitioners and others across the u.s. accused of a variety of scams, including a $900 million scheme in arizona targeting dying patients.

“it does not matter if you are a trafficker in a drug cartel or a corporate executive or medical professional employed by a health care company,” garland told reporters. “if you profit from the unlawful distribution of controlled substances, you will be held accountable.”

in the arizona case, prosecutors have accused two owners of wound care companies of accepting more than $330 million in kickbacks as part of a scheme to fraudulently bill medicare for amniotic wound grafts, which are dressings to help heal wounds.

nurse practitioners were pressured to apply the wound grafts to elderly patients who didn’t need them, including people in hospice care, the justice department said. some patients died the day they received the grafts or within days, court papers say.

in less than two years, more than $900 million in bogus claims were submitted to medicare for grafts that were used on fewer than 500 patients, prosecutors said.

the owners of the wound care companies, alexandra gehrke and jeffrey king, were arrested this month at the phoenix airport as they were boarding a flight to london, according to court papers urging a judge to keep them behind bars while they await trial. an attorney for gehrke declined to comment, and a lawyer for king didn’t immediately respond to an email from the associated press.

authorities allege gehrke and king, who got married this year, knew charges were coming and had been preparing to flee. at their home, authorities found a book titled “how to disappear: erase your digital footprint, leave false trails, and vanish without a trace,” according to court papers. in one of their bags packed for their flight, there was a book titled “criminal law handbook: know your rights, survive the system,” the papers say.

gehrke and king lived lavishly off the scheme, prosecutors allege, citing luxury cars, a nearly $6 million home and more than $520,000 in gold bars, coins and jewelry. officials seized more than $52 million from gehrke’s personal and business bank accounts after her arrest, prosecutors say.

in total, 193 people — including 76 doctors, nurse practitioners, and other licensed medical professionals — were charged in a series of separate cases brought over about two weeks in the nationwide health care fraud sweep. authorities seized more than $230 million in cash, luxury cars and other assets. the justice department carries out these sweeping health care fraud efforts periodically to help deter other potential wrongdoers.

in another scheme targeting native americans, phony sober living homes were set up promising addiction treatment. claims were then submitted for services that were never actually performed, officials said.

another case alleges a scheme in florida to distribute misbranded hiv drugs. prosecutors say drugs were bought on the black market and resold to unsuspecting pharmacies, which then provided the medications to patients.

some patients were given bottles that contained different drugs than the label showed. one patient ended up unconscious for 24 hours after taking what he was led to believe was his hiv medication but was actually an anti-psychotic drug, prosecutors say.

—

司法部搗破27億元醫療詐欺案 起訴近200人

聯邦司法部週四宣布搗破大規模醫療詐欺案,詐騙總額高達27億元,起訴近200人,當中70多人為醫生護士等註冊醫療專業人員。

聯邦司法部大規模掃蕩醫療詐騙案,起訴近200人,當中76名被告是醫生、護士和其他註冊醫療專業人員,詐騙案涉及的總額高達27億美元,當局查獲了超過2億3100萬美元的現金、豪華汽車、黃金及其他資產。

聯邦司法部長加蘭(merrick garland)說:「無論你是販毒集團的毒販,還是醫療保健公司僱用的企業高層或專業人士,都沒有關係,如果你從非法分銷受管制物質中獲利,你必被追究責任。」

當局指,在其中一個個案中,有被告人向病危的老人家提供非必要的植皮手術,然後向medicare聯邦醫療保險申請報銷,並獲得款項。

在另一個個案中,有藥品分銷商涉嫌銷售假和標示不實的藥物,作為hiv的治療藥物,其他被告則被指控為原住民,設立虛假的戒毒康復中心。

2024.6.20 alice lin’s husband died, and she found herself alone and caring for a disabled son. then two years ago, the 81-year-old alhambra woman said she started getting texts from a stranger on a messaging app.

a california senior lost $700k to scammers. now she’s asking the state to slow bank transfers

alice lin’s husband died, and she found herself alone and caring for a disabled son. then two years ago, the 81-year-old alhambra woman said she started getting texts from a stranger on a messaging app.

over the course of a series of friendly chats, he convinced her to wire $720,000 — her entire life savings — to a cryptocurrency app.

so she did – in seven separate in-person transactions at her local bank over three weeks. her life savings disappeared, along with the man who scammed her. for a time, she said she contemplated suicide. but then she got angry – at her bank.

“despite many red, red flags, my bank failed to consider that i might be a victim of elder fraud,” lin told the california assembly’s banking and finance committee this week. “and they did not even contact my daughter, who is the joint account holder on the account.”

in the months since, lin started working with consumer attorneys of california to sponsor senate bill 278, a measure aimed at preventing elder fraud scams like the one that drained lin’s investment accounts.

the bill, by napa democratic sen. bill dodd, would require that financial institutions delay transactions of more than $5,000 by at least three days if they “reasonably” suspect an elderly person is a victim of fraud. banks would be required to train their employees to spot red flags, such as an unusually large and sudden transaction. banks would also have to take steps to inform an elderly customer’s designated “emergency financial contact” or joint account holder – someone like lin’s daughter – of a suspected fraudulent transaction.

“elder financial abuse is everywhere,” dodd told the banking committee. “losses exceed $23 billion annually. once a senior falls prey to financial fraud, they may never recover.”

dodd’s bill passed the senate this spring with support from every prominent senior advocacy group in california, including the aarp. the measure originally faced intense opposition from the state’s banking and business lobbies, though they’ve since softened their stance after the bill was recently amended.

the financial institutions cite worries that they’d be forced into defacto conservatorships that would give them too much control over an elderly customer’s finances. the restrictions would also limit how quickly customers get their cash for legitimate expenses.

it was a concern shared by roseville republican sen. roger niello who cast the lone “no” vote when the bill was before the senate’s judiciary committee last month.

“as the bill exists now, it seems to me we run the risk of more conflict between seniors and their financial institutions than we do limiting elder abuse,” said niello, who used the opportunity to give dodd, 68, a good-natured ribbing about his age.

“i want you to know you don’t look a day over 90,” said niello, who is 76 and the third-oldest member of the legislature.

dodd told the assembly committee that the bill has been amended to limit the liability banks could face “when they do the right thing to protect elderly people, their customers.”

that eased some of the concerns from the 13 financial and business groups, including the california chamber of commerce, that are listed as opponents to dodd’s bill.

“we think what’s in front of us right now, while it’s going to be a heavy lift for credit unions, the good outweighs the work that’s going to go in there,” robert wilson, a lobbyist with the california credit union league, told the banking committee this week. “this is going to protect seniors.”

wilson and other bankers remain leery of how dodd’s measure would be enforced – a matter that dodd says will get cleared up by the time the bill reaches the assembly judiciary committee next week.

—

加州一名老年人被骗子骗走 70 万美元。现在她要求州政府放慢银行转账速度

爱丽丝·林的丈夫去世了,她发现自己孤身一人,还要照顾一个残疾儿子。两年前,这位 81 岁的阿罕布拉妇女说,她开始在短信应用程序上收到陌生人发来的短信。

在一系列友好聊天中,他说服她将 72 万美元(她一生的全部积蓄)汇入一款加密货币应用程序。

于是她就这么做了——三周内,她亲自到当地银行办理了七次交易。她的毕生积蓄消失了,连同那个骗她的男子一起消失了。有一段时间,她说她想过自杀。但后来她对银行感到愤怒。

林本周告诉加州议会银行和金融委员会:“尽管有很多危险信号,但我的银行却没有考虑到我可能是老年人欺诈的受害者。”“他们甚至没有联系我的女儿,她是该账户的联名账户持有人。”

此后几个月,林开始与加州消费者律师协会合作,发起参议院第 278 号法案,该法案旨在防止像林的投资账户被盗那样的老年人欺诈骗局。

纳帕民主党参议员比尔·多德 (bill dodd) 提出的这项法案要求,如果金融机构“合理地”怀疑老年人是欺诈的受害者,则应将超过 5,000 美元的交易延迟至少三天。银行将被要求培训员工识别危险信号,例如异常大额和突然的交易。银行还必须采取措施,将疑似欺诈交易通知老年客户的指定“紧急财务联系人”或联名账户持有人(例如林的女儿)。

多德告诉银行委员会:“老年人财务欺诈无处不在。每年损失超过 230 亿美元。一旦老年人成为金融欺诈的受害者,他们可能永远无法恢复。”

今年春天,多德的法案在加州所有知名老年人权益倡导团体(包括美国退休人员协会)的支持下在参议院获得通过。该法案最初遭到加州银行和商业游说团体的强烈反对,不过在法案最近被修订后,他们的立场已经软化。

金融机构担心,它们可能会被迫接受事实上的托管,从而对老年客户的财务拥有过多的控制权。这些限制还会限制客户获得合法支出现金的速度。

2024.6.18 the justice department today announced a 10-count superseding indictment charging los angeles-based associates of mexico’s sinaloa drug cartel with conspiring with money-laundering groups linked to chinese underground banking to launder drug trafficking proceeds. during the conspiracy, more than $50 million in drug proceeds flowed between the sinaloa cartel associates and chinese underground money exchanges. following close coordination with the justice department, chinese and mexican law enforcement informed united states authorities that those countries recently arrested fugitives named in the superseding indictment who fled the united states after they were initially charged last year.

—

superseding indictment

https://www.justice.gov/opa/media/1356301/dl?inline

—

press release

federal indictment alleges alliance between sinaloa cartel and money launderers linked to chinese underground banking

tuesday, june 18, 2024

for immediate release

office of public affairs

china and mexico took law enforcement actions following justice department’s investigation of alleged scheme to violate u.s. drug and money-laundering laws

the justice department today announced a 10-count superseding indictment charging los angeles-based associates of mexico’s sinaloa drug cartel with conspiring with money-laundering groups linked to chinese underground banking to launder drug trafficking proceeds. during the conspiracy, more than $50 million in drug proceeds flowed between the sinaloa cartel associates and chinese underground money exchanges.

following close coordination with the justice department, chinese and mexican law enforcement informed united states authorities that those countries recently arrested fugitives named in the superseding indictment who fled the united states after they were initially charged last year.

the multi-year investigation into this conspiracy—dubbed “operation fortune runner”—resulted in a superseding indictment returned on april 4 and unsealed on monday charging a total of 24 defendants with one count of conspiracy to aid and abet the distribution of cocaine and methamphetamine, one count of conspiracy to launder monetary instruments, and one count of conspiracy to operate an unlicensed money transmitting business.

the superseding indictment alleges that a sinaloa cartel-linked money laundering network collected and, with help from a san gabriel valley, california-based money transmitting group with links to chinese underground banking, processed large amounts of drug proceeds in u.s. currency in the los angeles area. they then allegedly concealed their drug trafficking proceeds and made the proceeds generated in the united states accessible to cartel members in mexico and elsewhere.

lead defendant edgar joel martinez-reyes, 45, of east los angeles, and others allegedly used a variety of methods to hide the money’s source, including trade-based money laundering, “structuring” assets to avoid federal financial reporting requirements, and the purchase of cryptocurrency.

twenty of the individuals charged in the superseding indictment are expected to be arraigned in the u.s. district court in downtown los angeles in the coming weeks, including one who was arraigned on monday.

“dangerous drugs like fentanyl and methamphetamine are destroying people’s lives but drug traffickers only care about their profits,” said u.s. attorney martin estrada for the central district of california. “to protect our community, therefore, it is essential that we go after the sophisticated, international criminal syndicates that launder the drug money. as this indictment and our international actions show, we will be dogged in our pursuit of all those who facilitate destruction in our country and make sure they are held accountable for their actions.”

“relentless greed, the pursuit of money, is what drives the mexican drug cartels that are responsible for the worst drug crisis in american history,” said dea administrator anne milgram. “this dea investigation uncovered a partnership between sinaloa cartel associates and a chinese criminal syndicate operating in los angeles and china to launder drug money. laundering drug money gives the sinaloa cartel the means to produce and import their deadly poison into the united states. dea’s top operational priority is to save american lives by defeating the cartels and those that support their operations. this investigation is the latest example, and there is more to come.”

“drug traffickers generate immense amounts of cash through their illicit operations. this case is a prime example of chinese money launderers working hand in hand with drug traffickers to try to legitimize profits generated by drug activities,” said chief guy ficco of irs criminal investigation. “we have made it a priority to identify, disrupt, and dismantle any money launderers working with drug cartels and we are committed to our partnerships with federal, state, and local law enforcement agencies to combat drug cartels and those who assist them in laundering drug proceeds.”

as part of this investigation, law enforcement has seized approximately $5 million in narcotics proceeds, 302 pounds of cocaine, 92 pounds of methamphetamine, 3,000 ecstasy pills, 44 pounds of psilocybin (magic mushrooms), numerous ounces of ketamine, three semi-automatic rifles with high-capacity magazines, and eight semi-automatic handguns.

background

the sinaloa cartel is largely responsible for the massive influx of fentanyl into the united states over the past approximately eight years, and for the accompanying violence and deaths that have afflicted communities on both sides of the border. the cartel’s activities generate enormous sums of u.s. currency in the united states that belong to the cartel in mexico. profits from the drug trade must be repatriated to mexico for use by the cartel.

chinese underground money exchanges in the united states assist the sinaloa and other cartels to move their profits from the united states to mexico by providing a ready market for u.s. currency in the united states.

many wealthy chinese nationals who live, work, or invest in china wish to transfer assets to the united states for various reasons but are barred by the chinese government’s capital flight restrictions from transferring the equivalent of more than $50,000 per year out of china. these individuals seek informal alternatives to the conventional banking system to move their funds.

to transfer money to the united states, the china-based investor contacts an individual who has u.s. dollars available to sell in the united states. the seller of u.s. dollars provides identifying information for a bank account in china with instructions for the investor to deposit chinese currency (renminbi) in that account. once the owner of the account sees the deposit, an equivalent amount of u.s. dollars is released to the buyer in the united states.

the sellers of u.s. currency in the united states obtain dollars in a variety of ways. some of them accept cash from individuals engaged in criminal activity that generates large amounts of bulk currency, including drug trafficking. these u.s. currency brokers charge a percentage commission as a fee to the owner of the criminal proceeds to conceal the nature and source of the funds—typically far less for their services than their competitors. drug traffickers increasingly have partnered with chinese underground money exchanges to take advantage of the large demand for u.s. dollars from chinese nationals.

the funds that are transferred in china are then used to pay for goods purchased by businesses and organizations in mexico or elsewhere such as consumer goods or items needed to aid the drug trafficking organization to manufacture illegal drugs, such as precursor chemicals, including fentanyl.

the superseding indictment

according to the superseding indictment, from october 2019 to october 2023, members and operatives of the sinaloa cartel imported large quantities of narcotics, including fentanyl, cocaine, and methamphetamine, into the united states, generating huge sums of drug cash proceeds in u.s. dollars.

in january 2021, martinez-reyes allegedly traveled to mexico to meet with sinaloa cartel members to strike a deal with money remitters with links to chinse underground banking to launder drug trafficking proceeds in the united states. after the deal was struck, the sinaloa cartel—through their connections and associates—distributed cocaine, methamphetamine, and other narcotics, generating u.s. dollars as drug proceeds.

martinez-reyes and other conspirators allegedly then delivered the currency—frequently in amounts of hundreds of thousands of u.s. dollars in cash—to other members of the chinese underground money exchange and remitting organizations to be laundered for a fee. the remitting organizations possessed large amounts of u.s. currency and could help wealthy chinese nationals evade china’s currency controls.

the money remitters allegedly disposed of the drug proceeds by either delivering united states currency directly to their money exchange customers or by purchasing real or personal property, including luxury goods and cars to be shipped to china. additionally, the remitters also moved illicit drug proceeds through cryptocurrency transactions. they also allegedly used a variety of traditional methods to place the funds into the traditional banking system such as purchasing cashier’s checks, or “structuring,” that is, depositing small amounts at a time into bank accounts opened for this purpose to avoid banks from reporting large cash deposits to the u.s. government.

the remaining seven counts charge individual defendants with crimes such as possession of pound quantities of cocaine and methamphetamine, structuring funds to avoid federal reporting requirements placed on banks, and one count of assault with a deadly weapon on a federal officer.

if convicted of all charges, each defendant faces a mandatory minimum of 10 years in prison and a maximum penalty of life in prison.

the dea, irs criminal investigation, south gate police department, downey police department, glendora police department, fullerton police department, and el monte police department are investigating the case, with valuable assistance from the fbi and u.s. marshals service.

assistant u.s. attorney julie j. shemitz for the central district of california is prosecuting the case. the justice department’s office of international affairs and criminal division’s narcotic and dangerous drug section’s special operations unit assisted with the investigation and overseas coordination in the case.

this case is part of an organized crime drug enforcement task forces (ocdetf) operation. ocdetf identifies, disrupts, and dismantles the highest-level criminal organizations that threaten the united states using a prosecutor-led, intelligence-driven, multi-agency approach. additional information about the ocdetf program can be found at www.justice.gov/ocdetf.

—

sinaloa drug cartel laundered millions through chinese network in l.a., prosecutors say

with millions in cash piling up in the united states, the sinaloa cartel needed to funnel proceeds from the sale of fentanyl, methamphetamine and cocaine back to mexico.

federal prosecutors say a ring of chinese nationals in the san gabriel valley offered a solution: marrying the sinaloans’ glut of bulk cash in greater los angeles with a demand from wealthy residents of china to transfer their money to the united states.

u.s. atty. e. martin estrada announced tuesday that a grand jury has charged 24 defendants — drug traffickers, couriers, bagmen and brokers — with conspiring to distribute drugs, money laundering and operating an unlicensed money-transmitting business.

the indictment described a straightforward system to transfer wealth out of china. the chinese government has restricted the flow of assets out of the country, creating an underground market for u.s. dollars that drug traffickers need to transfer back to mexico without using conventional banking systems.

chinese nationals are generally restricted from moving more than $50,000 a year out of the country’s financial system. in the money laundering system, prosecutors say, someone seeking to make a large transfer would contact a broker in california. the broker would then arrange for drug profits to be delivered to the chinese national’s representative in the united states, usually in bulk cash or a series of “structured” deposits small enough to avoid triggering anti-money-laundering controls.

at the broker’s direction, the chinese national would transfer money to a manufacturer in china that produced either consumer goods, such as electronics and clothing, or chemicals used to make synthetic drugs, estrada said.

shipped to mexico, the consumer goods would be sold and the money turned over to a cartel representative, returning the value of the drug dollars purchased by the chinese national to the cartel in pesos.

the chemicals, on the other hand, would be used to produce drugs such as fentanyl and methamphetamine in mexico for sale in the united states, triggering the cycle again, estrada said.

prosecutors allege the leaders of the money laundering ring, edgar joel martinez-reyes and peiji tong, traveled to mexico to strike a partnership with the sinaloa cartel in 2021. the men were photographed together in a car at the san ysidro border crossing, returning from what authorities said was the cartel meeting.

martinez-reyes’ attorney didn’t immediately respond to a request for comment. no lawyer was listed for tong in court records.

according to the indictment, hundreds of thousands of dollars in drug money changed hands at a time, packaged in shopping and duffel bags, satchels, backpacks and tin foil-wrapped packages. agents from the drug enforcement administration watched the handoffs at parkwest bicycle casino in bell gardens, an office complex in downey and a town house in temple city.

one alleged courier is charged with assaulting a federal officer after he smashed his lexus es350 into the officer’s car, trying to flee with $598,000 in vacuum-sealed bills inside his sedan, the indictment says.